Halloween time is here as kids of all ages celebrate the start of the Fall season, spooks, spirits, and of course, the tricks and treats. Children will wince as they pay their annual “Dad-tax” when their fathers inevitably comb through candy-filled pillowcases and nefarious teens will undoubtedly make off with several jack-o-lantern heists, gleefully tossing them from cars and listening for the dull thwump that comes from the sound of smashing pumpkins.

Of course, the image of squashed squashes conjures up memories of the hit alt-rock band, The Smashing Pumpkins, and specifically their song, 1979. Looking back at the year 1979, we find it was the seed of many significant implications that affect us today and, in many ways, reflects several of the key issues we face in 2023.

In 1979, geopolitical risks were rising significantly. Notably, Ayatollah Khomeini established the Islamic Republic of Iran, overthrowing the former Shah, setting the stage for the ensuing US embassy hostage crisis later that year. The Soviet Union invaded Afghanistan. Saddam Hussein rose to power in Iraq and Egypt signed a peace treaty with Israel. Closer to home, the Salvadoran civil war started, and the Sandinistas overthrew the Somoza democratic government in Nicaragua. The Three Mile Island nuclear reactor melt-down occurred in Pennsylvania, dashing hopes of any near-term alternative solution for energy independence in America. History certainly rhymes.

President Jimmy Carter initiated oil embargoes against Iran and faced a slow growth economy, energy supply instability, persistently high inflation and a more dangerous future as new enemies came to power and showed the world they were intent to advance their own agendas. In a speech entitled A Crisis of Confidence, President Carter highlighted the deep divisions within America as well as the dysfunction of our lawmaking institutions and called upon all Americans for a renewed sense of purpose and unity.

“I want to talk to you right now about a fundamental threat to American democracy… I do not refer to the outward strength of America, a nation that is at peace tonight everywhere in the world, with unmatched economic power and military might. The threat is nearly invisible in ordinary ways. It is a crisis of confidence. It is a crisis that strikes at the very heart and soul and spirit of our national will. We can see this crisis in the growing doubt about the meaning of our own lives and in the loss of a unity of purpose for our nation…”

Jimmy Carter

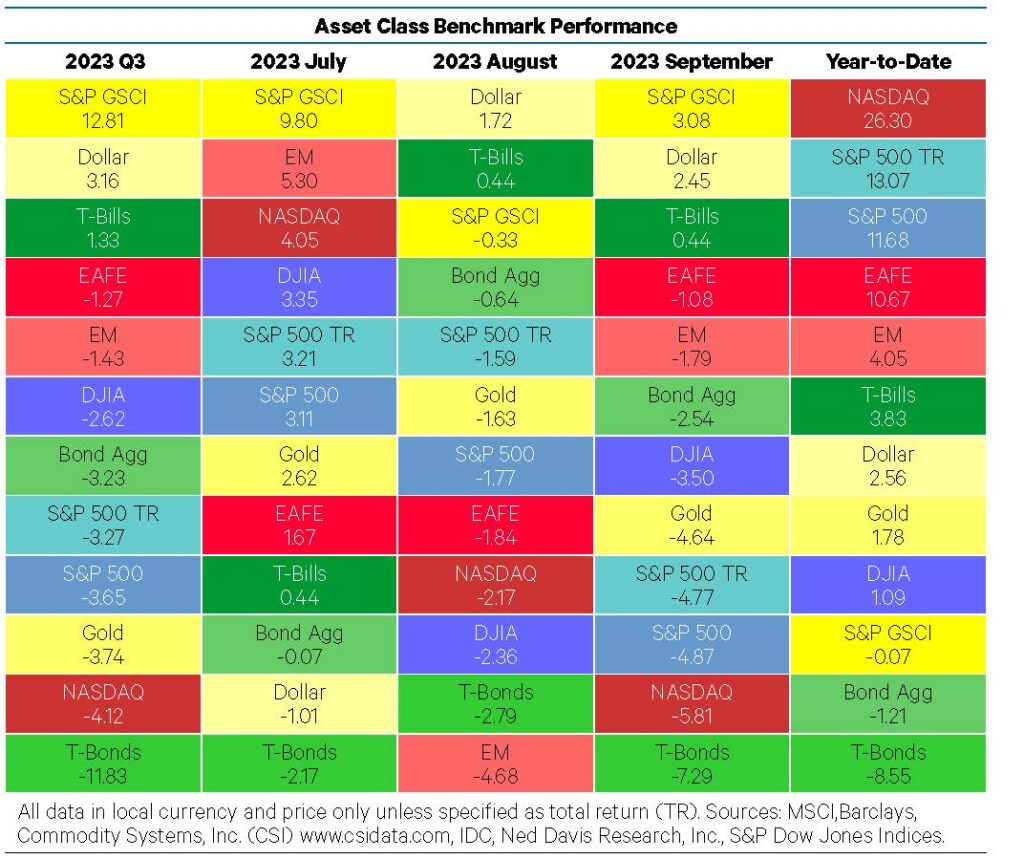

The more things change, the more they stay the same, it sometimes seems. Entering the final quarter of 2023, the markets have taken a decidedly more cautious tone, as equities and bonds are starting to price in a more uncertain world and the scenario that the Fed might keep rates elevated for longer than hoped. Indeed, the only assets that notched positive returns in Q3 were broad commodities (dominated by oil), the US Dollar and T-Bills.

Figure 1: Oil, Dollars and T-Bills: A Decisively Defensive Q3

Source: Ned Davis Research

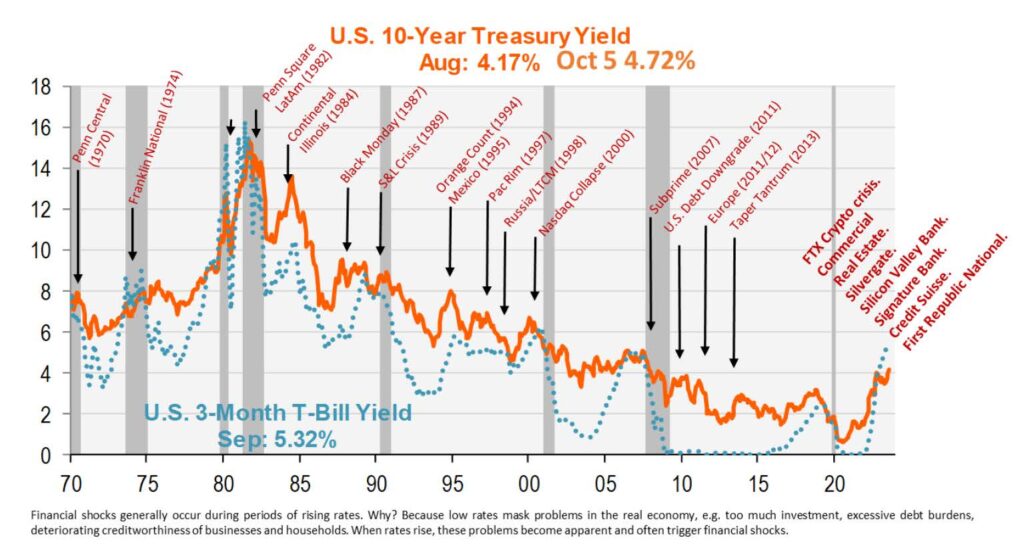

We are sticking with our recession call, and we expect that the markets will continue to price in a more difficult environment in the coming months. While we would love to be wrong, a look at historical financial shocks (defined by either a significantly higher cost and/or a lack of availability of capital) has preceded every recession since the 70’s. Ever since the Global Financial Crisis (GFC), the world has been awash with excess liquidity, and now the Fed, along with other major central banks are draining that liquidity from the financial system. As Warren Buffett famously quipped, “Only when the tide goes out, do you discover who has been swimming naked.” Parents, get ready to cover your kids’ eyes.

Figure 2: This Time is NOT Different

Source: Piper Sandler

It is difficult to determine if the Fed is done hiking rates, or if they will continue to increase them a couple more times over the next few quarters. In our view, potential future increases are of less importance than how long the Fed holds rates at an elevated level. Recall that rate hikes are the equivalent of putting a financial headlock on the economy and we believe the Fed will keep the chokehold going until these persistent inflation pressures finally tap out.

While our economy is likely past peak inflation levels, the housing shortage and sticky unit labor costs are making things particularly tricky for Chair Powell & Co. to accomplish their idealistic soft landing. Further complicating matters, additional yet necessary foreign aid packages to our allies will result in elevated US deficits, higher defense spending and serve as added unwanted fiscal stimulus into our still-too-hot economy.

Figure 3: The Fed & the US Economy, Illustrated

Source: Lucha Mexico

Economists are frequently wrong with their forecasts and divergent views make a market. Predicting the future was never supposed to be easy, save for those wicked witches equipped with their commercial-grade crystal balls. That said, it’s hard to argue with the fundamental laws of supply and demand.

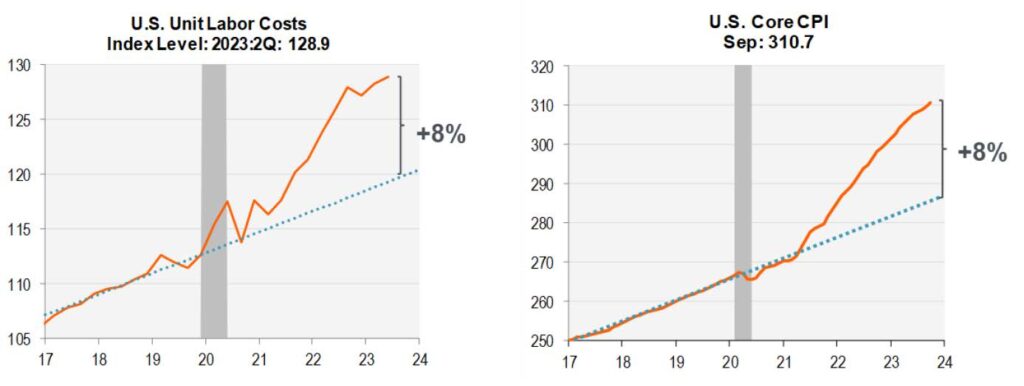

Thanks to the Covid-era labor shortage, higher wages are everywhere and now embedded into our system. From +40% airline pilot contracts to $20 per hour fast food workers, a materially higher wage impetus has been negotiated and legislated into our financial system. This condition will be felt for years to come and risks a higher base level of inflation becoming further entrenched.

In our post-GFC world, the “New Normal” of non-existent inflation and a seemingly endless supply of free money has now become a “New Abnormal” of persistently higher costs and persistently decreasing liquidity.

Figure 4: Sticky Labor Costs = Higher Prices Everywhere

Source: Piper Sandler

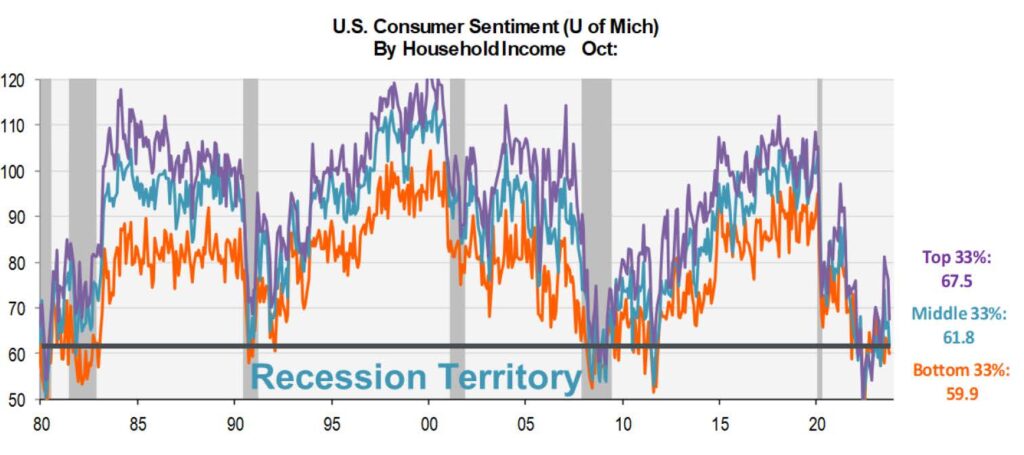

Consumers are feeling the pain. Real incomes are declining, while credit card balances and auto loan delinquencies are rising. Though history has proven it is a fools’ game to bet against the American consumer (or at least their spending habits), it looks very likely that a reckoning lies ahead.

Figure 5: Consumers’ Real Incomes Declining

Source: Piper Sandler

We have written extensively about our conviction in the power of the business cycle and its associated playbook, the HOPE (Housing, new Orders, Profits, Employment) model. So far, the cycle is playing out as expected and we see no plausible reason why it would deviate from its present course. While the equity and debt markets will gyrate on Fed expectations, we would expect a macro environment where corporate earnings remain under pressure and weakening demand and rising unemployment emerge over the next several months. We also expect that a credit crunch will continue to unfold as a wave of $1T+ of corporate and commercial real estate loans mature and need to be refinanced in the face of a dramatically higher interest rate regime. Consumers will likely not find much relief either as mortgage, auto and credit card rates will remain elevated for the foreseeable future.

Though we expect a challenging and volatile environment ahead of us, we are comforted by the fact that short-term market disruptions and economic cycles do little to derail long-term investment and financial plans. We continue to work with our clients to ensure their asset allocations are in line with their goals and that their portfolios are properly diversified.

We continue to believe that allocating assets to both public and private markets improves the probability of success for our clients’ outcomes. In fact, this inflationary environment demands a broader toolset and more investment capabilities as stock/bond correlations rise dramatically as inflation increases. Stock/bond correlations are roughly 20% when inflation is below 2% but rise to 60% when inflation is between 2%-4% and increase to a whopping 100% when inflation is 4%+.

Our current strategy incorporates a tilt towards Quality companies across our equity profile, slightly less duration and higher credit quality in our fixed income profile and a full allocation to diversified real assets including natural resources, infrastructure and inflation-protected bonds. Where appropriate, we advocate for a full complement of private credit and private real estate including core plus and net lease vehicles, as we believe these strategies are well positioned for the go-forward environment. Lastly, we are opportunistically deploying assets to highly curated private equity strategies for our Qualified Purchaser clients.

We shall see what the markets have in store for us as we close out 2023, and hopefully investors are rewarded with more treats than tricks. Regardless of conditions, please know we are here for you and are happy to assist with any of your questions or financial needs. Until next quarter, we wish you a wonderful Fall and holiday season ahead.

Figure 6: Echoes of President Carter: A Crisis of Confidence?

Source: Piper Sandler

Our Capital Insights readership continues to grow and encompasses clients, prospective clients, strategic partners, as well as friends of our firm. To our clients, we deeply appreciate your business and trust in your Capital Planning Advisors team. If you are not a client and are contemplating initiating a relationship with us, either directly with your personal or business assets, or by referring someone you think could benefit from our services and approach, we would be delighted to speak with you.