Memorial Day is here and in addition to a day of remembrance and gratitude, it marks the unofficial start of Summer. Seems like it was just yesterday we were tallying the number of atmospheric rivers in the West, and now in the season of Moms, Grads and Dads, we are tallying the daily tornado counts twisting their way up from the Gulf Coast to the Great Lakes. In the three months since the last installment of Capital Insights, we find the war in Ukraine continues to grind on, the war in Gaza has gotten worse, general international relations have become further strained, and the dysfunction in Washington DC further devolves as the political jockeying continues in the face of the spectacle of the looming US Presidential election. What a year, and we’re not even halfway done yet.

From a market perspective, one would be hard pressed to guess that we find ourselves in the sort of geopolitical backdrop described above. Broad equity markets have been nothing short of remarkable, returning 10%+ through the first five months of the year, all while the odds of seven Fed rate cuts in 2024 have been systematically weaned down to one by the end of this year, maybe. 10-year bonds continue to trade around pre-GFC levels in the 4.5%ish range as the world eagerly waits to see if Chair Powell & Co. have truly quelled inflation.

While there is no doubt significant progress has been made in reducing inflationary pressures from the peak levels of 2022, that progress seems to have ground to a halt as of late. The Fed remains in a tricky position: keep monetary policy tight enough, long enough to reduce inflation to their 2% target, all while not committing an unforced error of tipping the US economy into a recession. Readers of the last several quarters of Capital Insights will recall we have held the opinion that rates would be higher for longer than markets expected and that we would find ourselves in a recession by now. So far, we’ve gotten one out of two calls right, and while we are positively surprised at the resilience of the US economy and associated labor market, we aren’t quite throwing in the towel on our recession call yet. Indicators are starting to show growing stress in our system from the increased cost of money and the persistence of higher rates. Taking inflation from 8% to 4% was the easy part, going that last mile from 4% to 2%, not so much. As with any long journey, whether it be a 26.2-mile marathon or a cross-country road trip with the kids to go see family, the last mile is the hardest.

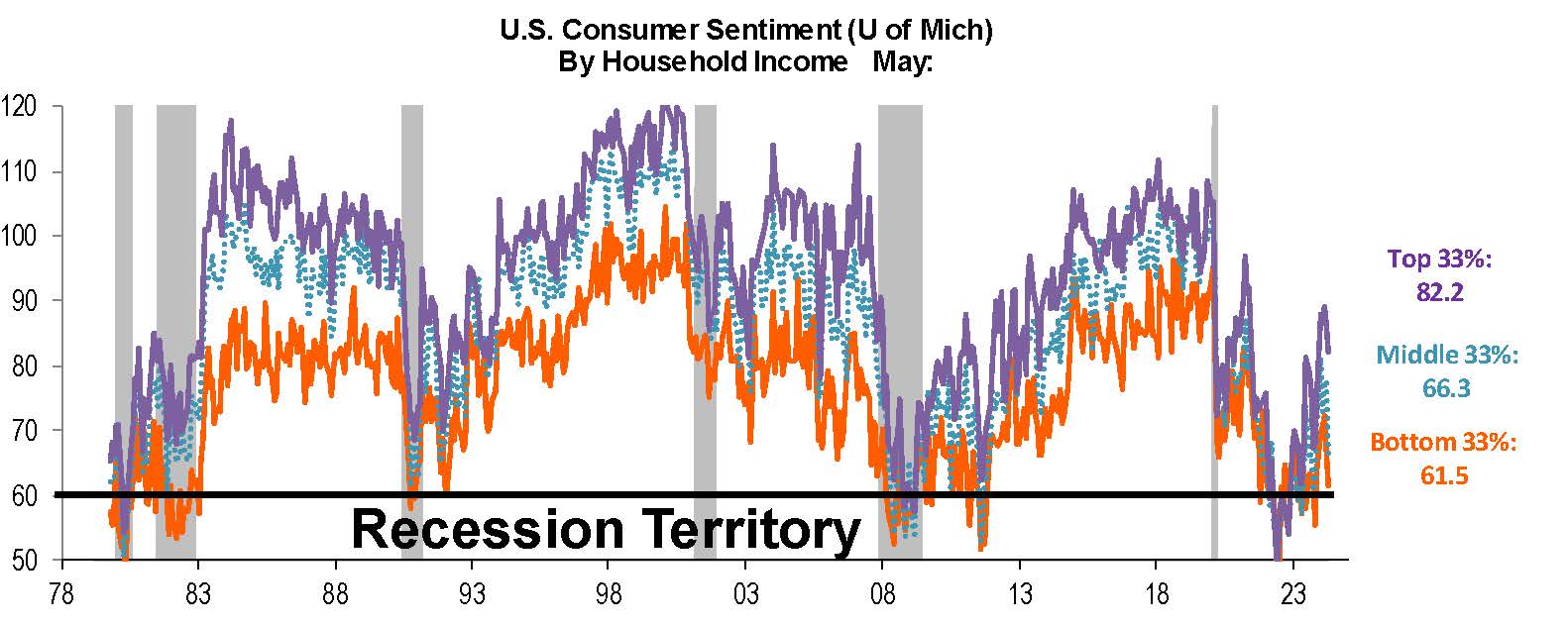

Sometimes good news is bad news, and sometimes bad news is good news. As we collectively further detox from the massive policy interventions of the Covid-era, markets are now reflexively reacting positively to weaker economic data in hopes of speedier rate cuts. Conversely, good economic news has equated to bad market returns, since that implies the Fed can maintain higher rates for longer since the economy is strong enough to withstand them at present. We suspect even the 80’s pop band, Duran Duran, would be perplexed by investors wishing for worse news. To us, this somehow feels akin to rooting for your real team to lose the game because your fantasy player keeps scoring for the opposite team.

Figure 1: The Reflex: The Answer to the Question Mark?

Source: Piper Sandler

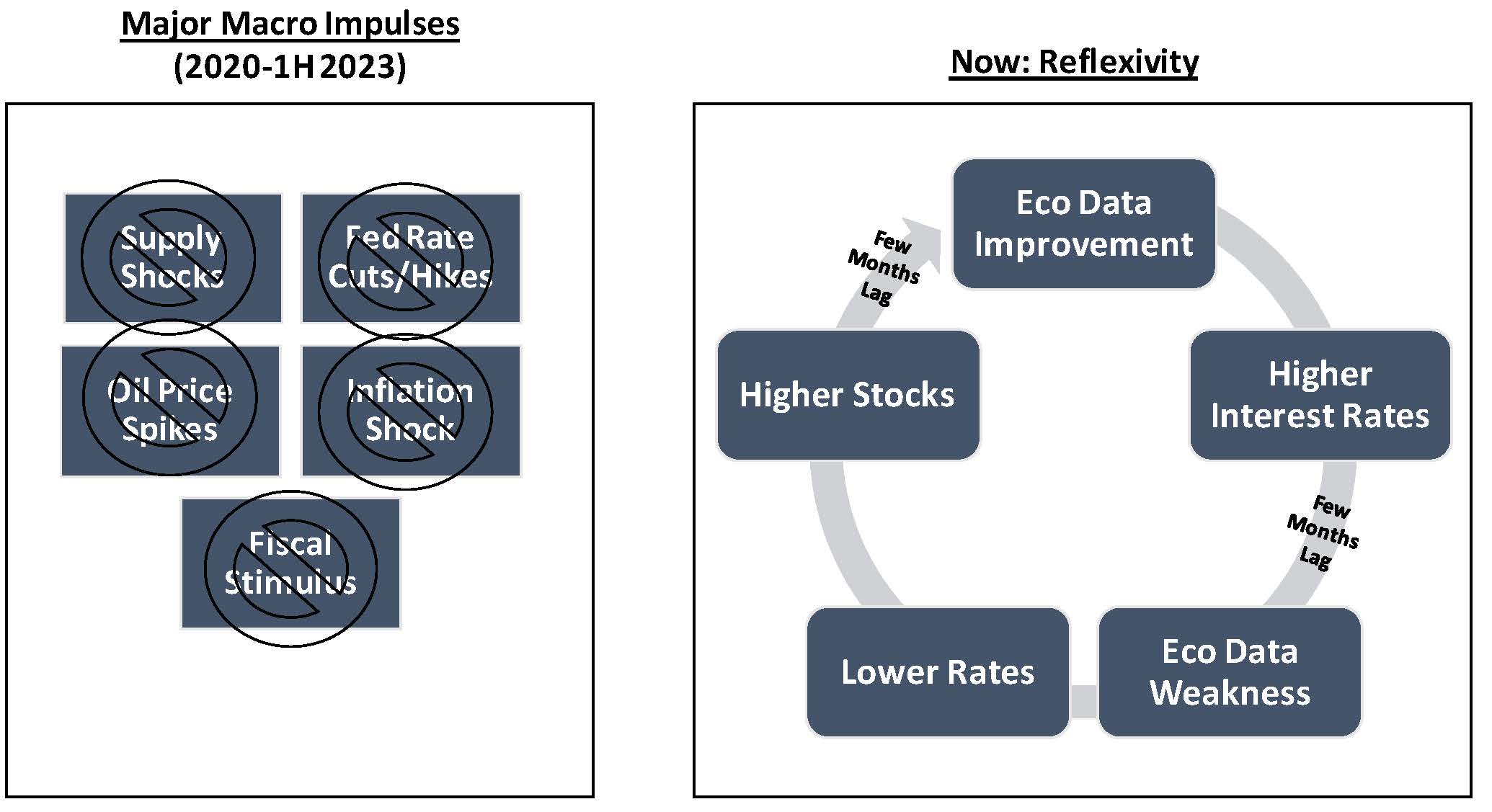

While it feels nice that the stock markets have already put in a full year’s work of returns before the summer solstice, we are keeping our eyes on the bond market. It seems everybody (including us) loves to keep talking about the Fed and short-term rates, but more important are longer term inflation expectations, which are signaled by 10-year treasury rates.

Our macro partners over at Piper Sandler put together a nifty chart that we think does an excellent job explaining the importance and the impact of the bond market to the stock market. Recall that bond markets are a function of monetary policy (rates), economic growth and inflation expectations. Nominal yields that are either too high or too low would indicate either policy error or major intervention because either (1) inflation expectations became unhinged or (2) the economy broke. The takeaway is keep an eye on 10-year rates.

Figure 2: Not Too Hot, Not Too Cold: Looking for Goldilocks in 10-Year Rates

Source: Piper Sandler

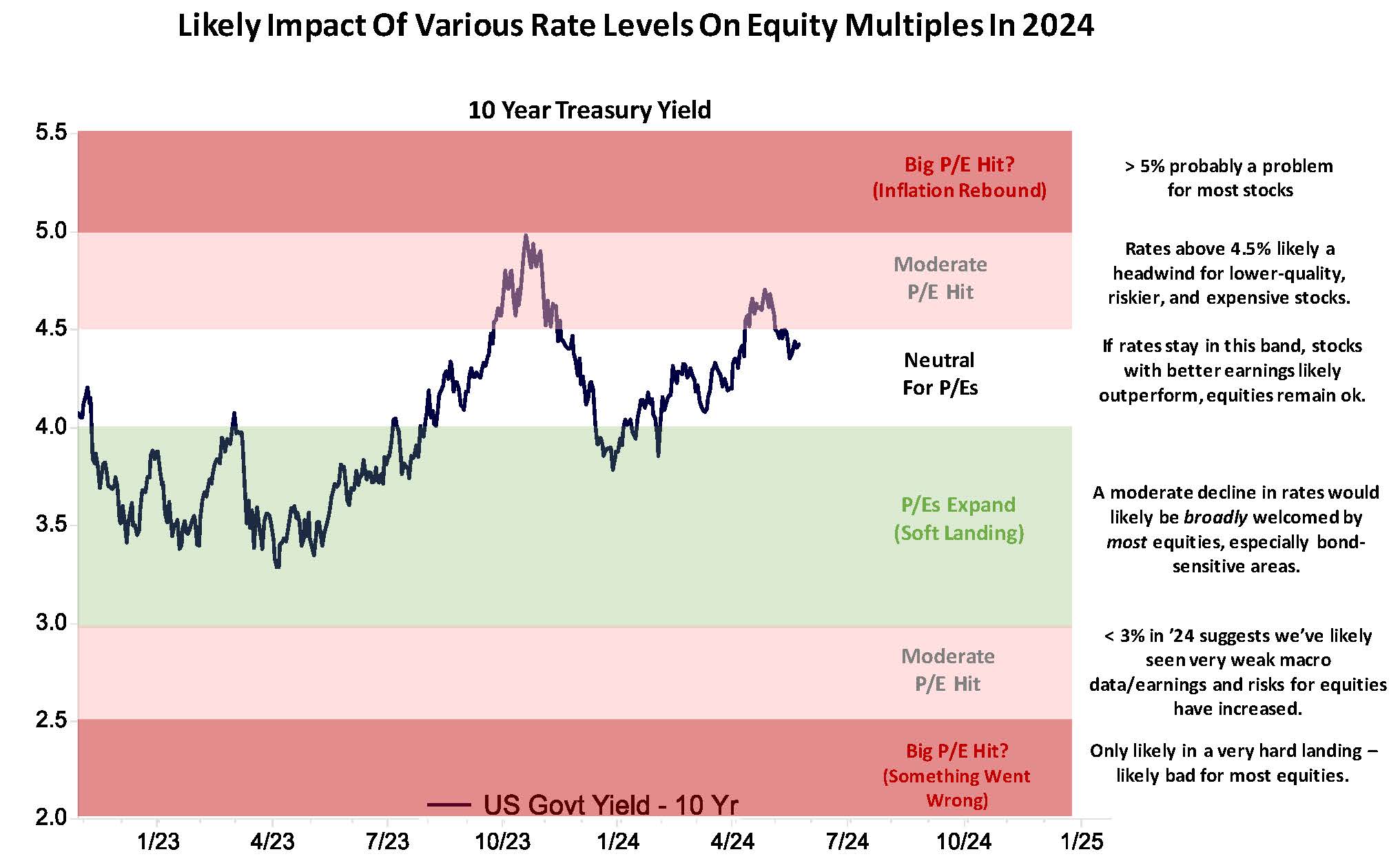

While it’s fun to ponder macro policy from intellectual ivory towers, conditions back on the ground level of the general consumer are far more sobering and the true impact of what 4% inflation feels like is becoming more apparent daily. Materially higher rents, insurance, utilities, food costs, gasoline and daycare expenses are hammering the average consumer – and there is no relief in sight. We have written before about the decline in household savings rates, rising credit card balances and consumers’ waning ability to keep spending. Average credit card rates are now more than 21% these days and with our nation’s aggregate consumer credit card debt north of $1.1 trillion dollars, something has to give.

Higher income consumers are generally a bit more insensitive to higher rates as they have more disposable income and generally healthier balance sheets. However, lower income consumers are tapped out and middle-income consumers are now getting squeezed. The middle-income consumer is important to watch as they tend to have the highest propensity to consume, so any erosion in their ability to do so would have an outsized impact on overall consumer spending, which in turn affects our overall GDP.

While the macro data indicates that our overall economy isn’t technically in a recession yet, we suspect that if you surveyed 10 random people at your local Target, many of them would say that they are borderline experiencing a personal recession.

Figure 3: Sentiment Near Recessionary Levels for Some

Source: Piper Sandler

It’s very clear to us that the road ahead is very unclear, as very smart strategists cite excellent points on both sides of the debate regarding the likelihood of rate cuts, recessions, election outcomes and the relative firmness of economic landings. The good news is that there is a pretty solid playbook to help ensure client success throughout these uncertain times – namely, asset allocation, diversification and remaining invested. Albert Einstein famously said that compounding was the eighth wonder of the world, but the caveat is that investors must give it time to work.

To help our clients navigate through this painstakingly slow last mile of disinflation, we are ensuring that their investment portfolios are properly exposed and participating in the mega trends that are shaping our collective future. We provide this access to our clients through both public and private investment strategies, where appropriate.

The digitization of our economy, e-commerce, rise of artificial intelligence, and the transition to more robust energy and infrastructure capabilities all are secular forces that will help propel markets, productivity and standards of living to new heights. There is more to participating in these trends than simply buying a few well-known semiconductor chip stocks or mega-cap technology companies. In fact, we can make the case that we are providing our clients’ exposure to the last mile of each of these themes: all that data has to reside in a server farm in some data center somewhere; all that electricity has to be transmitted and distributed to the end consumer in Everytown, USA to charge their car, send that text, or order their next DoorDash; and perhaps most importantly, these innovative companies that are helping to improve our future need to find strategic sources of capital from skilled and patient investors.

We are pleased and excited to incorporate all these durable and compelling themes into our investment strategy and invite you to discuss them with your Advisor.

Our Capital Insights readership continues to grow and encompasses clients, prospective clients, strategic partners, as well as friends of our firm. To our clients, we deeply appreciate your business and trust in your Capital Planning Advisors team. If you are not a client and are contemplating initiating a relationship with us, either directly with your personal or business assets, or by referring someone you think could benefit from our services and approach, we would be delighted to speak with you.