Cue the synthesizers; fire up the keyboards. Hit the smoke machine. Here we go, America, it’s finally here…The Final Countdown. Just days away from the 60th quadrennial Presidential election and weeks away from closing out the 2024 calendar year, we find ourselves with perhaps more uncertainty than ever before. Trump or Harris? Escalation or resolution in the Middle East and Ukraine? Fed Cuts or Pause? Soft Landing or Hard? Blue or Red?

While the rhetoric and hyperbole coming from both sides of the aisle is suggestive of The End of Days if each doesn’t get the outcome their team wants, we expect that the Earth will keep on turning come November 6th. Rest assured, there’s no need to blast off into space, despite what Europe, the glam-rock, big-hair band’s 1986 hit single, The Final Countdown, might recommend.

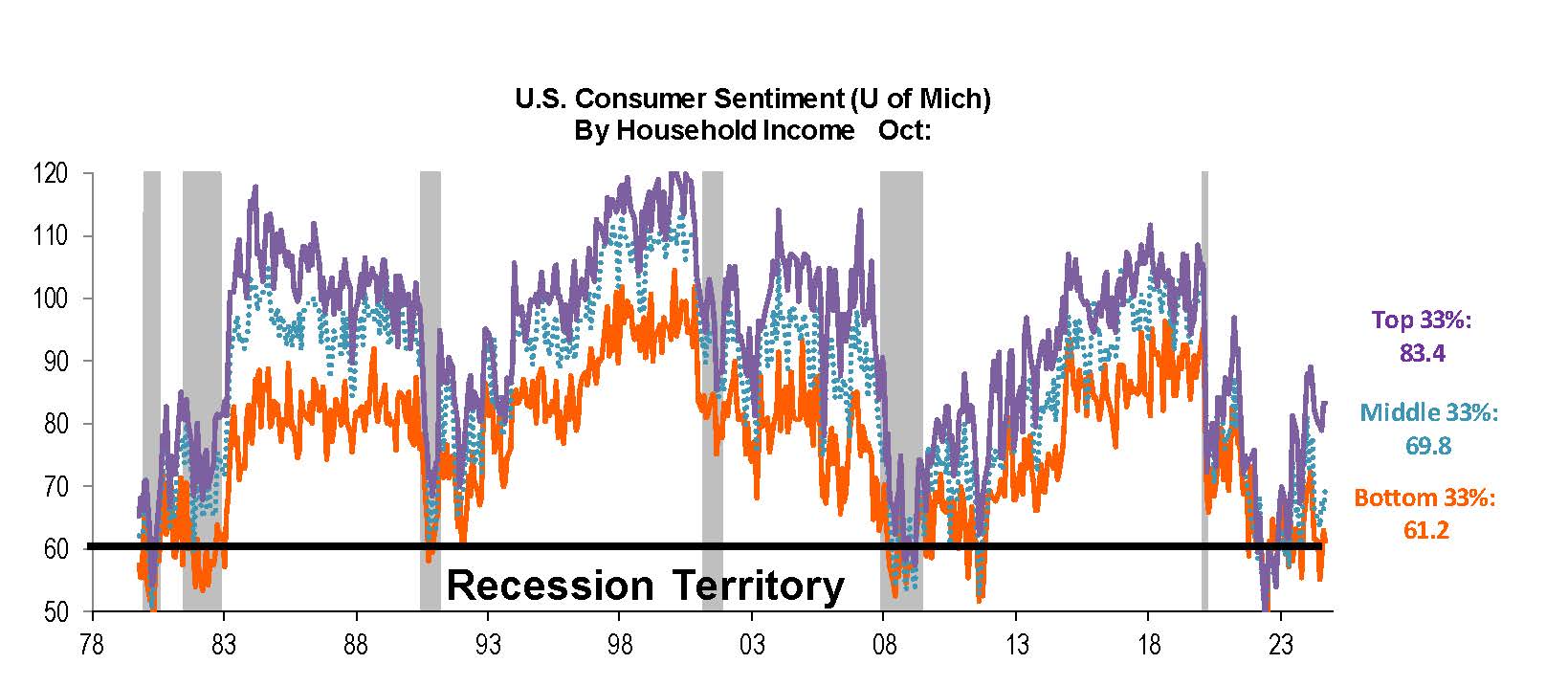

Markets are sanguine, and despite some midyear volatility, have resumed their steady climb, with several indexes reaching new highs as of this writing. Short of some spectacular curveball, 2024 is shaping up to be a very good year for the markets in general. Q3 wrapped up with global stocks doing well across the board, bucking the trend of typical seasonal weakness. Gold has rallied to new highs, and currently leads the asset class pack on a year-to-date basis.

Figure 1: Gold, Still Shining

Source: Ned Davis Research

We are about a third of the way into Q4 and well as into the latest earnings season. So far, so good as earnings have held up remarkably well to date, and importantly, future guidance is still positive. We are coming off stronger than expected GDP reports, stronger than expected employment reports and continuing moderating inflation. Let the Good Times Roll, to quote Ric Ocasek.

Now just hold on a moment…we are about to flip the calendar page to November and still no recession. What about all the aforementioned predictions of grim economics, rising unemployment and the certainty of the historical business and economic cycle? What gives? Well, we must admit, we are surprised too, and pleasantly at that. However, nothing is ever as simple as it seems, and crosscurrents remain below the surface.

We are still big fans of the HOPE (Housing, Orders, Profits, Employment) model, and believe it does an excellent job explaining the business cycle. Recall that our economy is mainly driven by consumer spending, and of course, employment levels are a very important signal of economic health. When people have jobs, they spend money; when they don’t have jobs, they can’t. September’s blowout employment report reset the calculus for our estimate of our present location in the business cycle, and many professional forecasters were surprised at the strength and resilience of the US consumer. So, while we continue to believe in the business cycle, it seems like we are in an elongated one and perhaps one with shallower ups and downs.

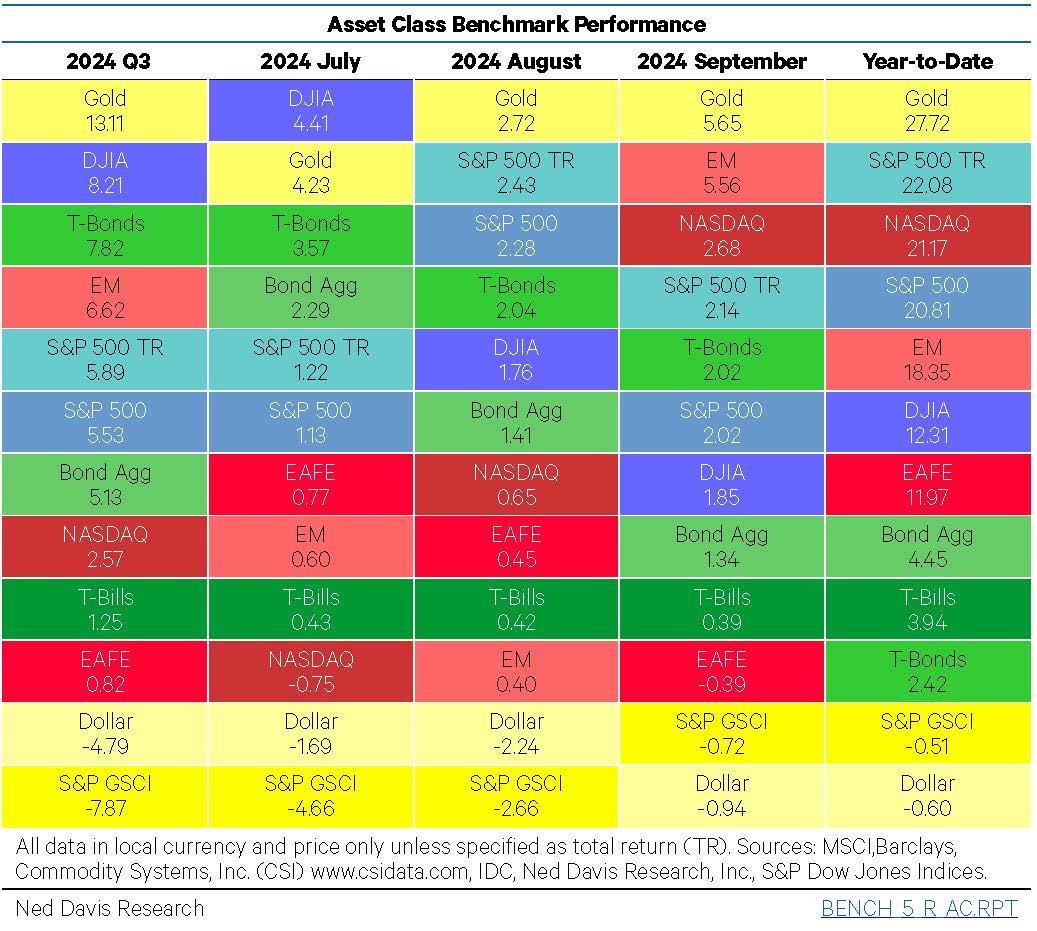

One of the key supports for consumer spending and resilient corporate profits is the reacceleration of monetary and fiscal support. Money supply is stealthily growing again and it’s no surprise our government continues to deficit spend. As both interest rates and the cost of capital fall, money churns faster through our economic plumbing and spurs income generation both on the corporate and personal side. The chart below shows an uncannily tight relationship between the data. The accelerated resumption of deficit spending also helps explain some of gold’s price performance this year.

Figure 2: Still Flying, Not Landing…Yet

Source: Piper Sandler

So, while we cannot stop the business cycle tides, perhaps the learning is that we can slow the effects of their undulations a bit with good old economic stimulus.

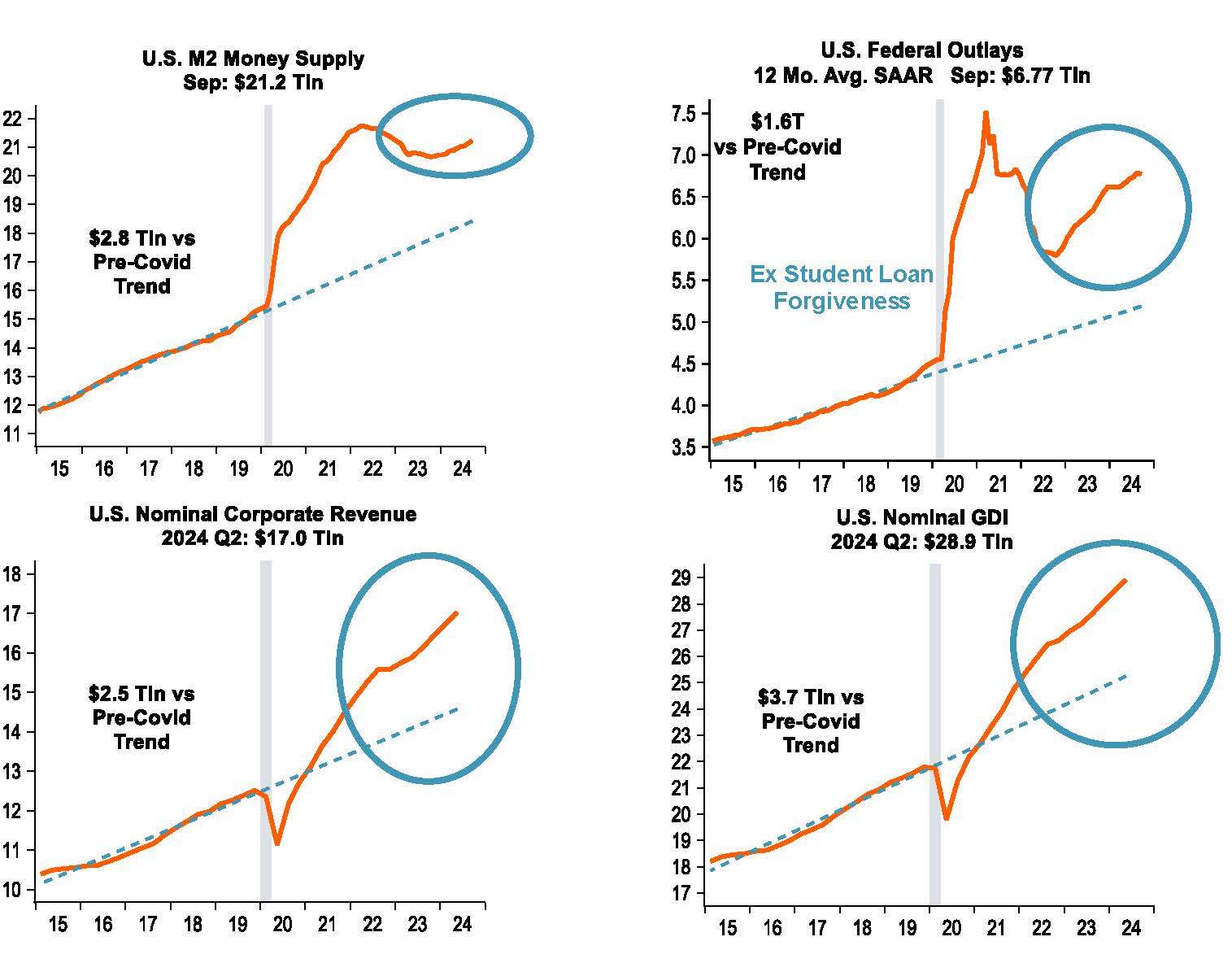

Headline numbers never really tell the entire story though, and as mentioned before, there are complicating factors to this narrative. While it is true that spending has remained strong, wage growth is positive, and sentiment is picking up due to slowing inflation, these conditions have been dramatically different when looking at the consumer by income decile.

Roughly speaking, the cohort of the top 20% income households account for about 40% of overall consumer spending, and their spending dwarfs the rest of the 80% of the lower income households. In fact, the data shows that the lower end consumer is essentially tapped out and their spending has fallen off a cliff.

The easing financial conditions have benefitted the upper income cohorts due to rising home prices, rising stock prices and greater discretionary income; however, the lower income households, who tend to rent, not have stock portfolios and less discretionary income, continue to struggle with the higher price levels that are now embedded in our economy. These conditions explain the stark contrast in consumer sentiment below.

Figure 3: Clear Skies Ahead for Top 20%; The Rest? Not So Much.

Source: Piper Sandler

How much this bifurcation dynamic affects the outcome of the upcoming election remains to be seen. Historically, the economy is consistently the primary factor in determining how people vote – not so much on a national level, but on a personal one. Issues, such as do people have a job, how much they make and how much things cost really matter at the end of the day.

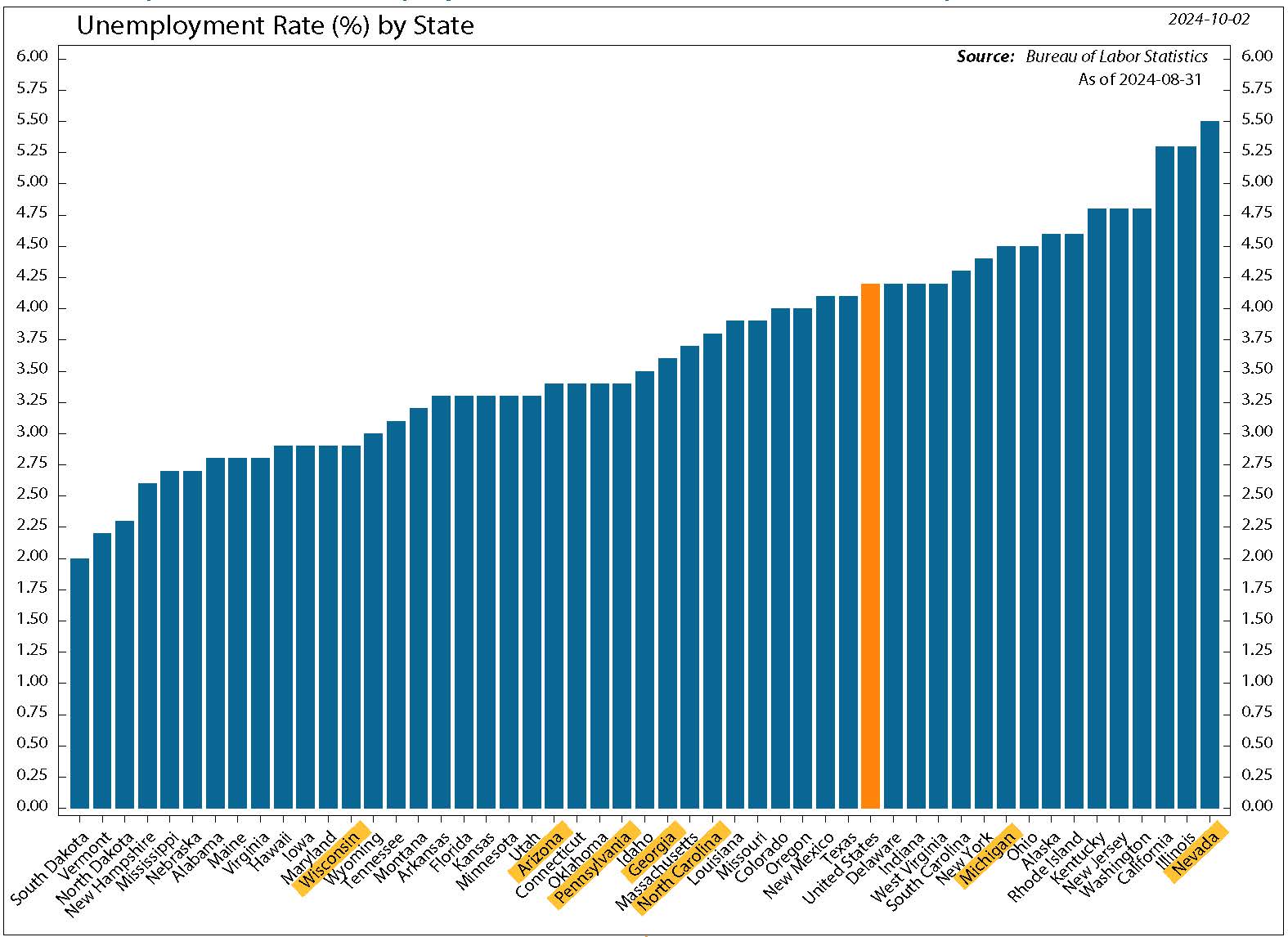

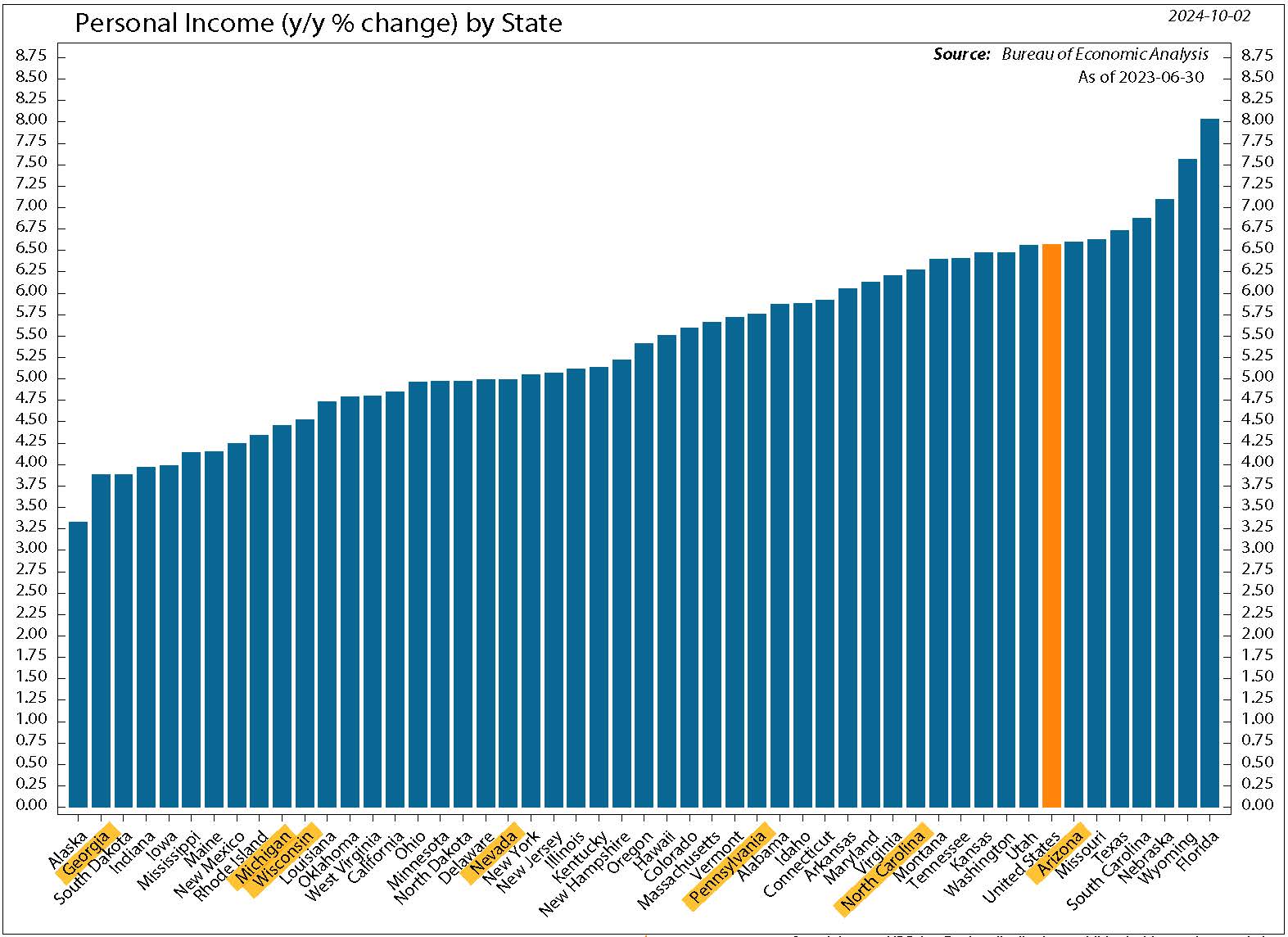

Pollsters and political strategists suggest that the election will come down to seven swing states, and when viewed through the lens of personal economics, the picture is clear as mud. Namely, unemployment in swing states is lower than the national average, but conversely, income growth in those states are lower than the national average as well, which implies that inflation may be front and center of swing-state voters’ minds.

Figure 4: Good News for the Incumbent: Swing State Unemployment Below National Average

Source: Ned Davis Research

Figure 5: Good News for the Challenger: Swing State Income Growth Below National Average

Source: Ned Davis Research

It’s natural to feel some anxiety and tension in the face of a Presidential election. This one seems to have had an excessive amount of drama surrounding it, no doubt. While the outcome of the Presidential election is too close to call, our sources in Washington suggest the highest probability outcome continues to be a divided government, and that a sweep by one party is unlikely. This is an important point to consider because generally, markets do well in divided government regimes, where no one party controls both Congress and the White House.

We do expect some short-term volatility as the election nears, passes and its results are invariably challenged after the fact. Regardless, we would caution clients to not react to this volatility as election effects tend to be short-lived.

The next two weeks will see the remaining bulk of S&P earnings be reported and we will be watching closely. Hopefully the results will continue to be positive, and we will experience a steady climb into year-end. We are keeping an eye on bond yields, which have crept up noticeably in the past two weeks and are now near 4.25%. This could be indicative of a positive view on future economic growth, or a more sinister concern that inflation is creeping back into the system. Time will tell.

Longer term, we continue to advise our clients to stick to their strategic asset allocations and continue to review their financial plans. In the case that tax laws and estate laws do change, it will be important to consider what planning options may be available, and we will be happy to assist you in that process.

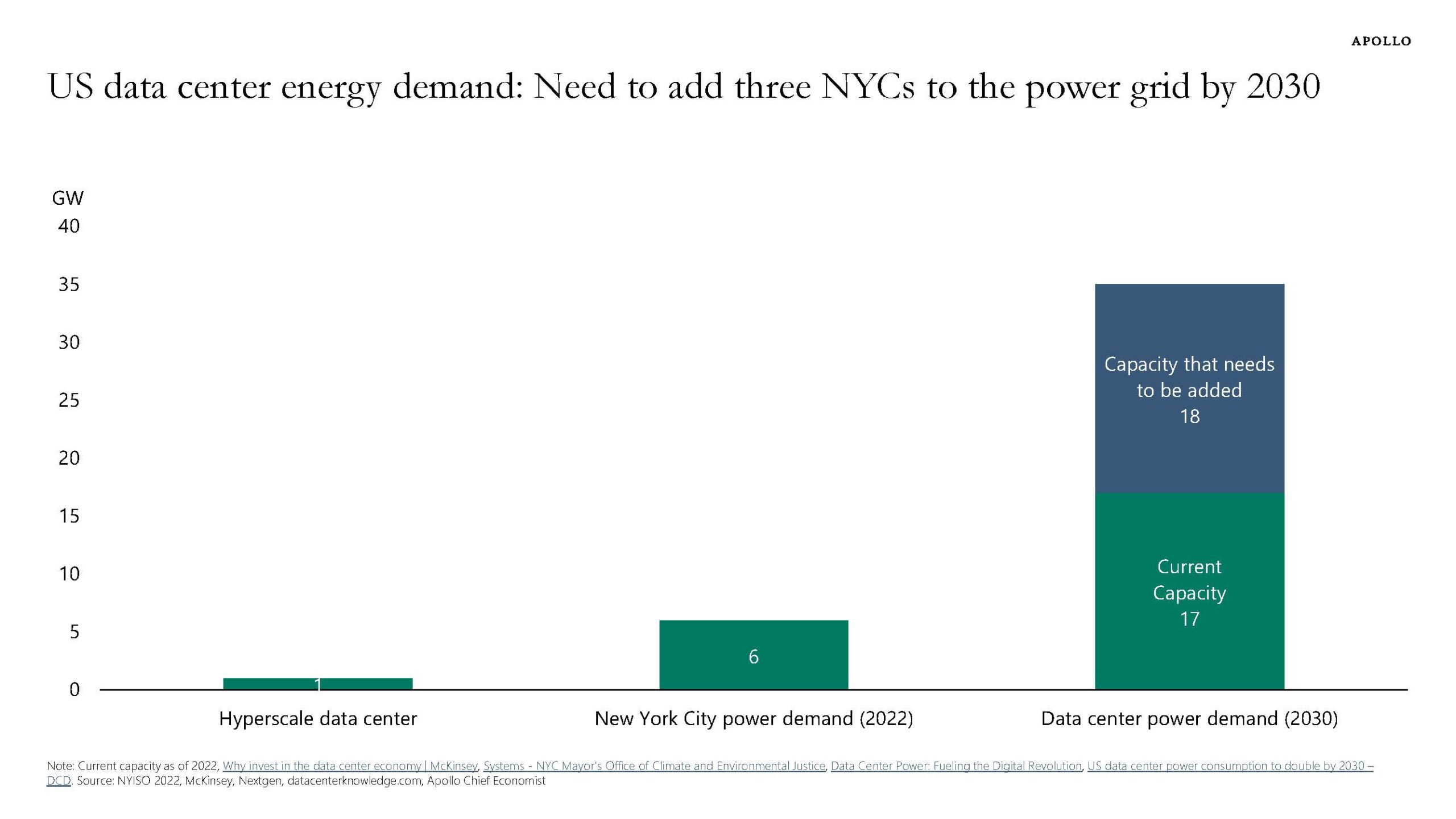

From a thematic standpoint, we continue to bring unique and diversified exposures to our clients, which allow them to participate in the megatrends that are shaping our world around us. The combination of the AI boom and the Infrastructure Act has contributed to a renaissance in digital infrastructure spending including data centers, grid enhancement and renewable energy. We are pleased to be able to provide institutional access points to these exciting opportunities and developments through all major asset classes, including equity, credit and real assets.

Figure 6: How Do You Like Them (Big) Apples?

Source: Ned Davis Research

We have not changed our equity profiles in the last quarter because we continue to believe that large cap, quality stocks will outperform in the intermediate term regime. We also continue to maintain a neutral stance on duration and up-quality in fixed income. In real assets, we are maintaining our longstanding gold position and are adding to infrastructure, data center and student housing exposures.

We appreciate your continued support of our firm and your trust in our team. If you know of someone who might benefit from our services, we would welcome your referral. Until next quarter, we wish you a very happy and healthy holiday season with friends and family.