No Man’s Land is often referred to as a contested space where warring factions refuse to retreat yet cannot advance. It’s a place characterized by uncertainty, significant risk, dynamic tension and little, if any control. In World War I, No Man’s Land was the desolate area sandwiched in between the trenches of the Allied Forces and the German war machine. Sadly today, No Man’s Land is still present in Ukraine and Gaza as the world observes the tragic conflicts from afar.

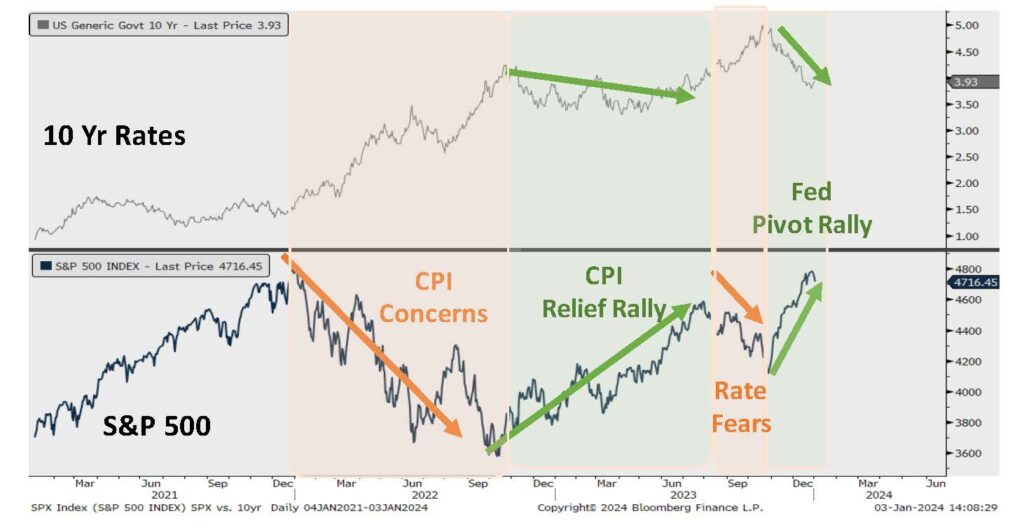

In a market and economic context, we enter 2024 finding ourselves in a similar situation. The US economy continues to plug along nicely, inflation is clearly declining, and consumers continue to spend, spend, spend despite increasing signs of financial stress. That said, capital costs are significantly higher, the scarcity of capital is materially greater, and markets are pricing in a half-dozen rate cuts this calendar year.

While we generally prefer optimism over pessimism, logic dictates that after the largest and fastest rate hiking cycle in modern history, the odds of us getting off scot-free are pretty low. Coming off a massive everything-rally in Q4, we see a forward environment filled with uncertainty, significant risk, dynamic tension and little, if any control.

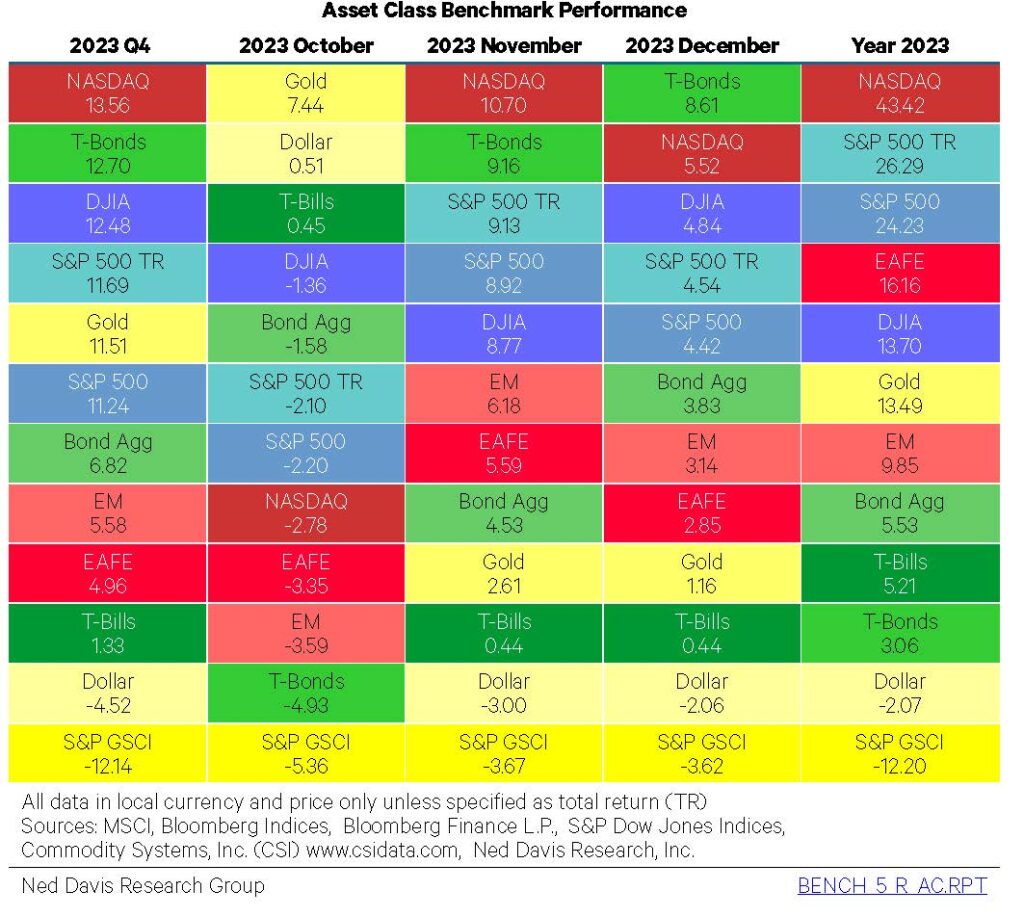

Figure 1: Receding Inflation Lifted All Assets in 2023 (Except Commodities)

Source: Ned Davis Research

Equities were the big winners in 2023, with tech leading the way by a large margin. While earnings (ex-Magnificent Seven) were flat to slightly down, investor enthusiasm about near-term rate-cut expectations drove P/E valuations a full three points higher during the year. Credit spreads and volatility measures continued to decline as markets priced in reduced risk of defaults for lower-rated debt. Any concerns about 2023 being history’s largest year of regional bank failures (at a combined value of $550B) proved to be short lived. Further, markets simply yawned at the US credit rating downgrade in August, which was only the second occurrence of that fun fact in history. Why worry? One could make the case that the entirety of 2023’s market performance has been based on the back-and-forth speculation of when and how much the Fed will cut rates. If we could nominate a theme-song that epitomized last year, The Clash’s, “Should I Stay, Or Should I Go?” gets our vote.

Figure 2: Inflation: If It Goes There Will Be Trouble, If It Stays There Will Be Double

Source: Piper Sandler

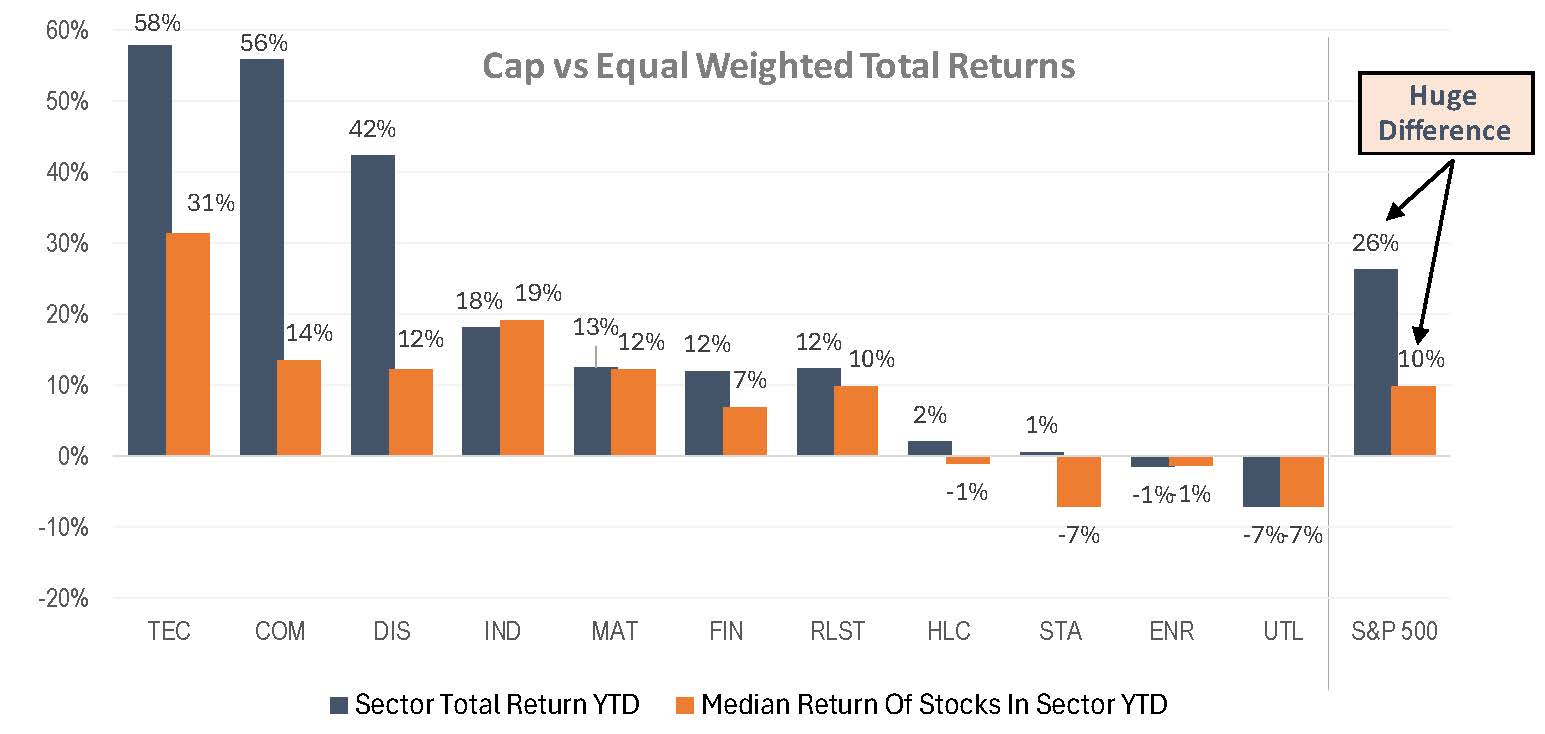

The Magnificent Seven (Mag 7) saved the equity market’s bacon last year. No, we’re not referring to Brynner, McQueen and Bronson, et al., we are referring to the big beneficiaries of AI – Apple, Microsoft, Google, Amazon, Nvidia, Meta and Tesla. We too are excited at the prospects of AI and how large language models and advancements in computing power will help bring improvements in productivity and benefits to society, but it is the significant outperformance of the Mag 7 relative to the rest of the broad markets that is unsustainable. While the capitalization-weighted S&P 500 returned a massive 26% in 2023, that return would have only been 10% on an equal-weight basis. Stated another way, despite terrific headline market returns, the average stock price performed “just OK”, and the rest of the market needs to catch up if this recent rally is going to prove sustainable.

Figure 3: Magnificent Seven, Illustrated

Source: Piper Sandler

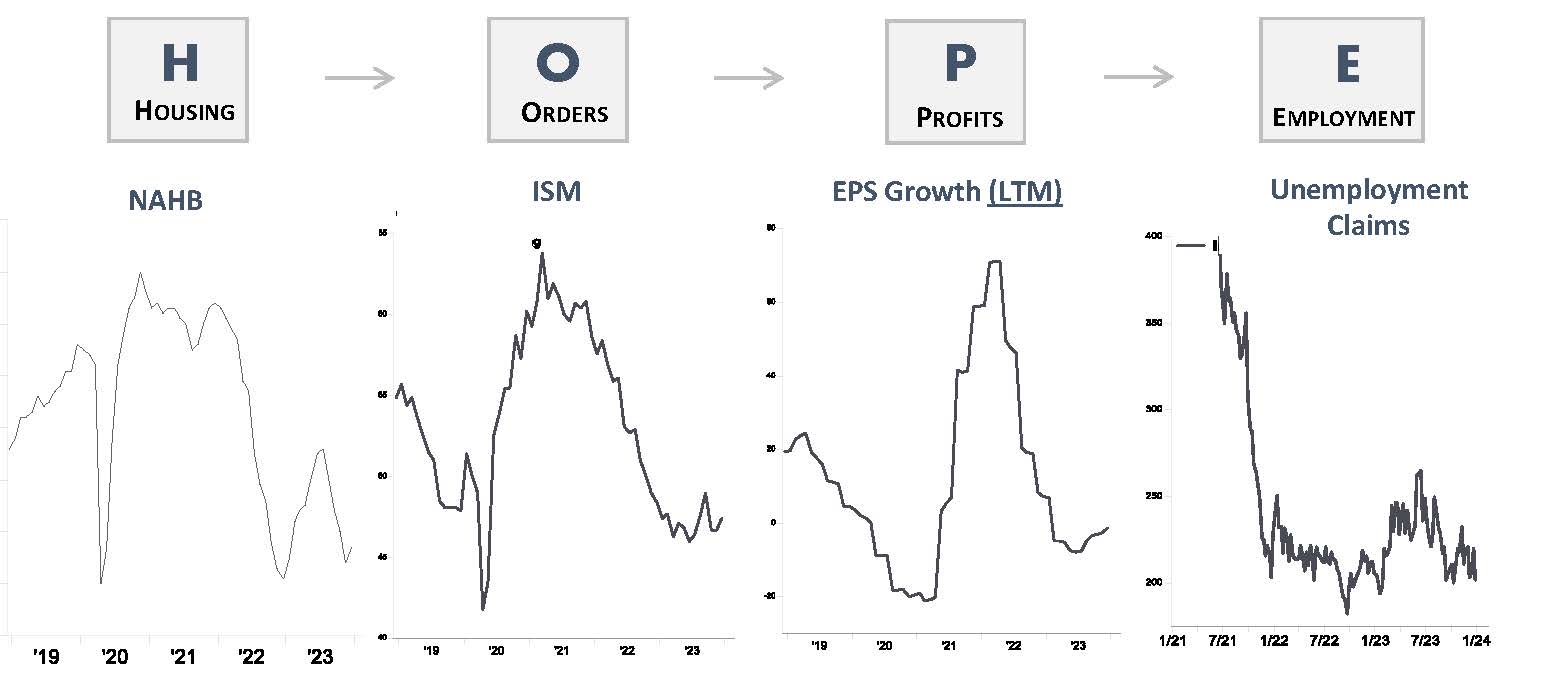

Regular readers will recall our frequent citation of the HOPE model, which does an excellent job pairing economic and market cycle data and provides some clarity as to what we might expect to come next. So far, the script has gone according to plan – Housing has rolled over, then new Orders declined, and Profit growth then subsided on a relatively smooth glide path, just like the model predicted. What hasn’t cracked just yet is Employment, the last step in the cycle model. Admittedly, we are a bit surprised at the resiliency of the labor markets, and while there is some noticeable cooling at the margin, employment numbers continue to remain very strong. Is it possible the Fed can engineer their soft-landing in a backdrop of immaculate disinflation? Perhaps. Just because it hasn’t happened before, doesn’t mean that it can’t happen now. At the same time, we are acutely aware and are very cautious about falling into the hazardous mind trap of simply believing, “It’s Different This Time.” We’ll see.

Figure 4: Will This Cycle End With HOP or HOPE?

Source: Piper Sandler

So what’s an investor to do? Are we out of the woods yet or will inflation make a comeback? Are central banks going to stand pat or cut rates? Have we seen the worst of stock and rate volatility or are there more painful adjustments ahead? Are markets underestimating forward conditions or do they have it right? No Man’s Land.

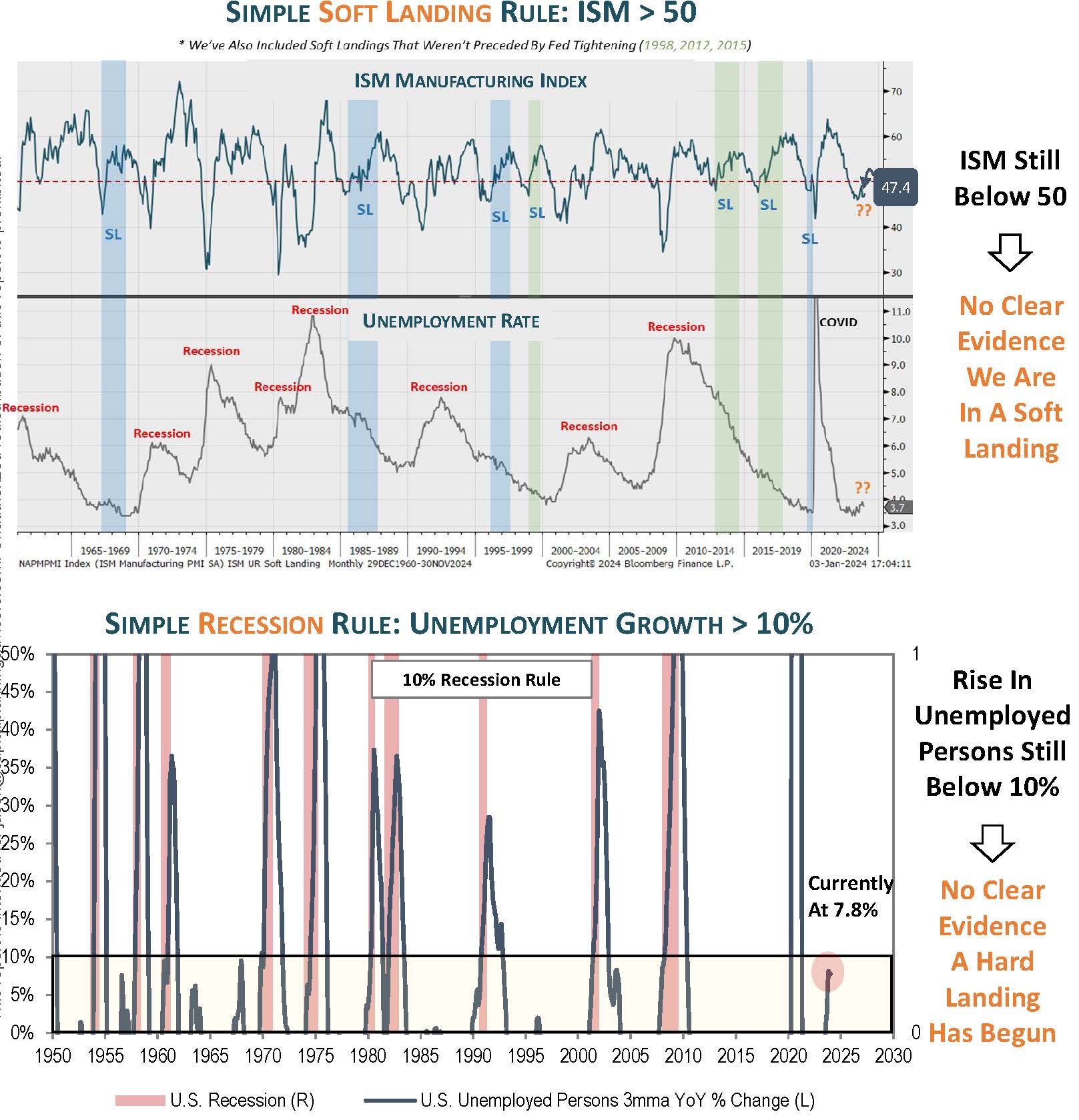

We don’t claim to have any clearer crystal ball than the next investment strategy group, nor do we think we can guess what the Fed is going to do when they don’t yet know themselves. What we do know is that while the current environment is far from clear at present, clarity will come fairly rapidly as this year progresses. We are keeping a close eye on both the ISM (New Orders) as well as unemployment growth over the coming months to give us a better sense of which way this cycle is going to end.

Figure 5: Your Guide to No Man’s Land, Economic Edition

Source: Piper Sandler

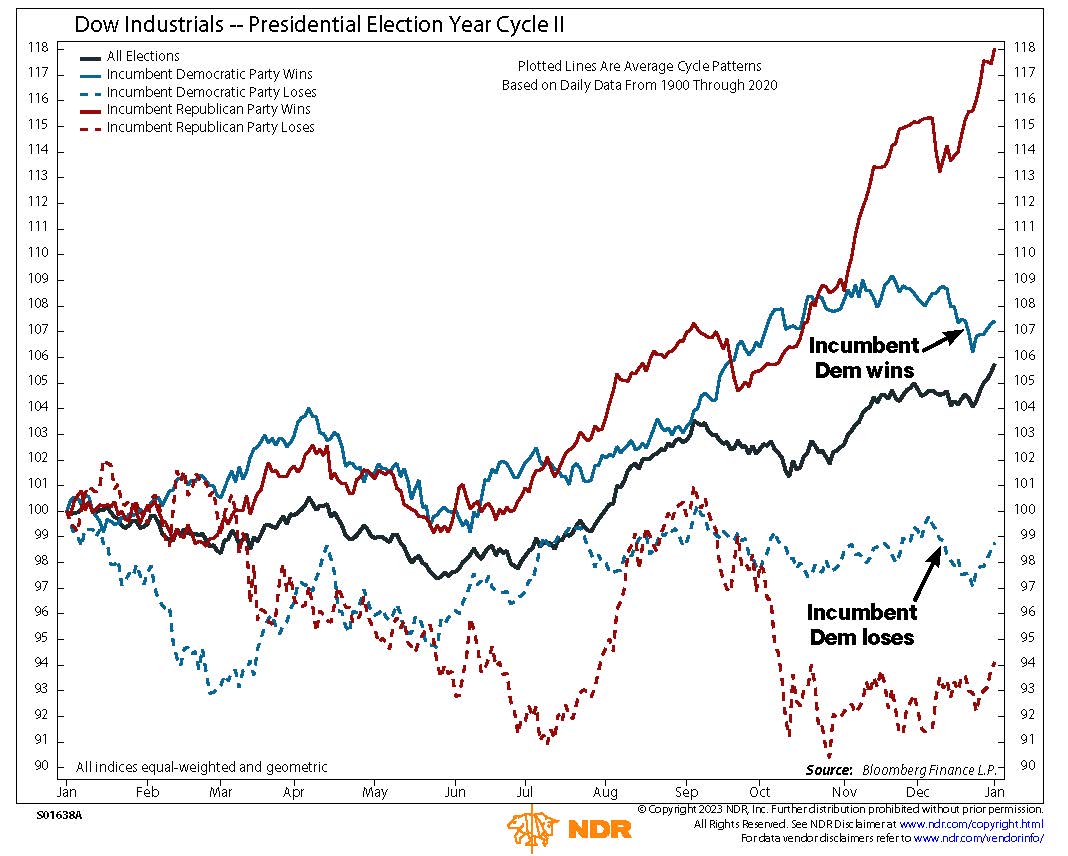

We would be remiss if we did not mention the upcoming Presidential election later this year, which is undoubtedly on investors’ minds. It is important to recall that each economic, monetary and fiscal regime is different throughout electoral history, but with that in mind, we can go back and look at quantitative outcomes in the markets. Historically speaking, market median returns during election years is about 10% and returns tend to be weaker when the incumbent party loses.

We would caution clients to refrain from making any investment decisions that would impact their long-term portfolios based on this year’s election as geopolitical events rarely have any material long term effect on market returns. Regardless of the exact timing of any monetary easing pivots, we are much closer to it now than we have been before, and any rate cuts will be powerful tailwinds for risk asset prices. Don’t fight the Fed.

Figure 6: Election Influences

Source: Ned Davis Research

We are comfortable with our current positioning and strategy and do not anticipate any major shifts in the coming quarter. Given the backdrop, we are neutral in our allocation weight to equity, with a preference for large cap domestic equities that exhibit Quality factors. We are slightly underweight fixed income and neutral on duration. We are retaining a full allocation to our suite of private capital strategies where appropriate.

We do expect that equity markets will finish higher at the end of 2024 than where they began and that interest rates will be lower. Volatility looks to be higher in the first part of the year as Fed expectations reconcile with reality and as election outcome speculation vacillates. Regardless of conditions, please know we are here for you and are happy to assist with any of your questions or financial needs. Until next quarter, we wish you a happy and healthy start to the New Year.

Our Capital Insights readership continues to grow and encompasses clients, prospective clients, strategic partners, as well as friends of our firm. To our clients, we deeply appreciate your business and trust in your Capital Planning Advisors team. If you are not a client and are contemplating initiating a relationship with us, either directly with your personal or business assets, or by referring someone you think could benefit from our services and approach, we would be delighted to speak with you.