The 2024 Summer Olympics have just wrapped up and have provided spectators across the world with awe, inspiration and emotional moments of high drama that only sport presented on the grandest stage and performed at its highest level can deliver. For the past two weeks, the Olympic games have offered a welcome and perhaps much-needed distraction from the continuing challenges taking place in the electoral, geopolitical, market and economic environment around us.

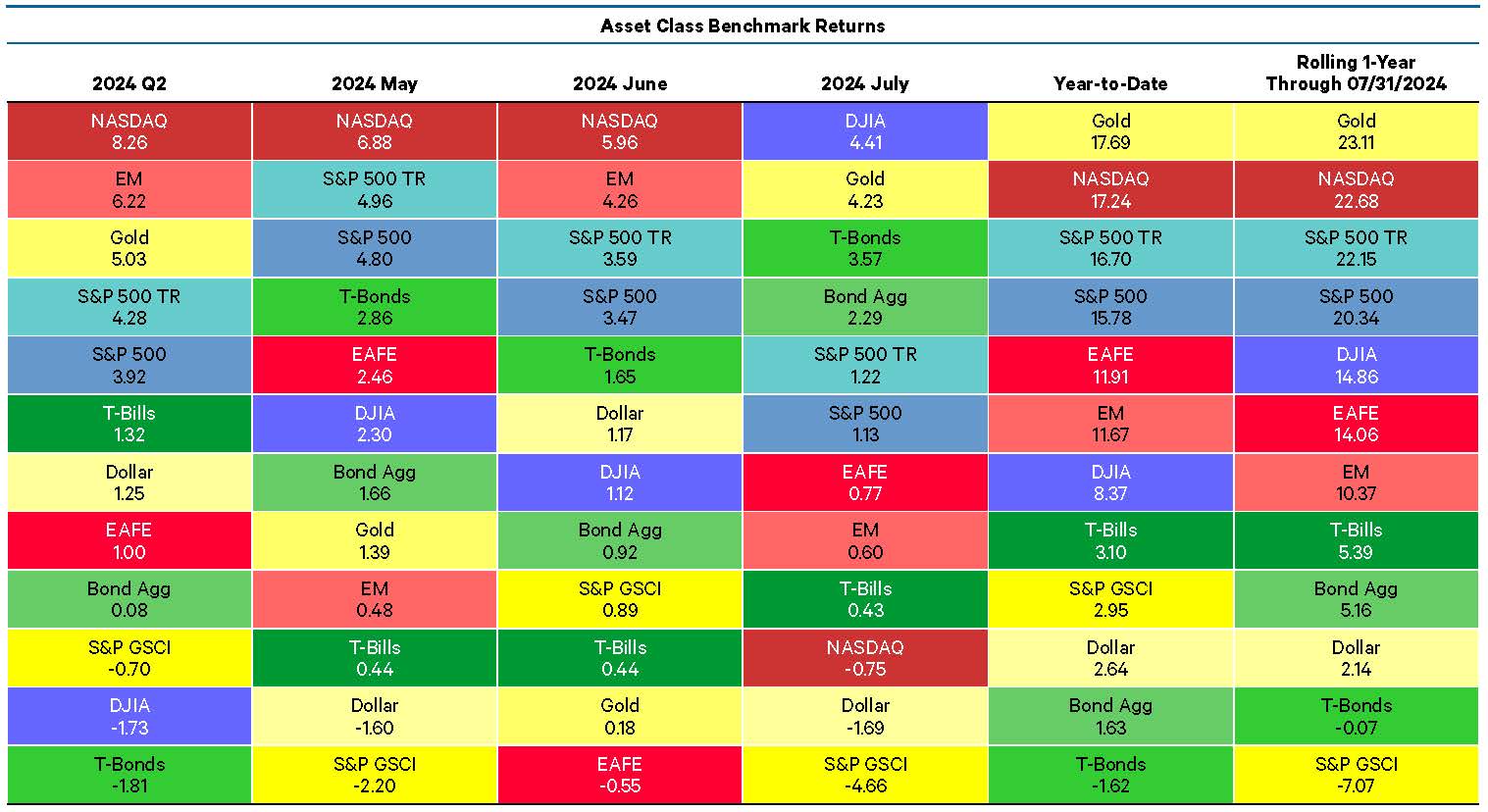

From a market perspective, 2024’s six-month strong start ended with a thud as the everything-rally came to an abrupt halt when volatility collided with the global markets in late July and early August. First half equity market gains quickly evaporated, bond yields plunged, and market cap and sector rotations spun about with the dizzying speed and strength of a Team USA gymnast. As the noise dies down from our most recent equity market correction, the scorecard tally reveals the surprising fact that gold, of all asset classes, has held up best over the course of this calendar year and trailing twelve months. (At the time of this writing, gold continues to outpace the S&P 500 and Nasdaq by roughly 5-7%.)

Figure 1: YTD and 12-Month Champion: Gold takes the Gold

Source: Ned Davis Research

So how did we get here? Economic data has continued to progressively soften, to nobody’s surprise, as the Fed has maintained a sufficiently restrictive monetary policy to keep the disinflation train a-rolling on. There is little doubt that the broad economic trend continues to be “just fine” (as in “not great” or “not necessarily horrible”) with purchasing managers’ indexes (PMIs) hovering in mediocre territory, housing starts subsiding, CPI deflating and unemployment inching higher, all in an orderly fashion.

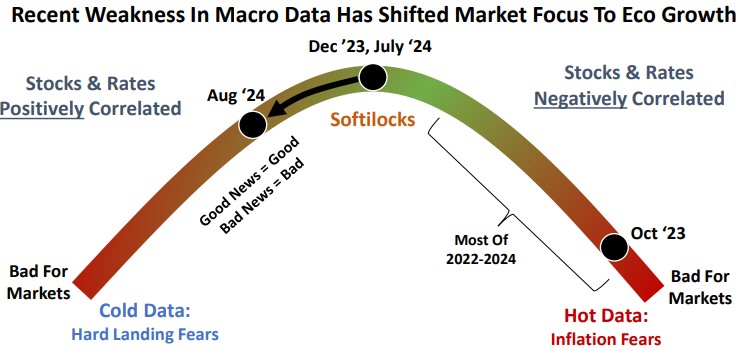

Our research partners at Piper Sandler have cleverly dubbed this regime “Softilocks,” in reference to Goldilocks and her three bear buddies, where inflation declines, and the economy slows into the fabled soft landing without adversely impacting the health of the labor market. This idyllic scenario in our opinion (along with AI exuberance; more on that later), is the primary reason for most of the positive returns from markets over the past 18 months. Then July’s employment report happened.

A weaker than expected jobs report took the unemployment rate from 4.1% to 4.3%. The Sahm Rule, which nobody outside of econometric academia had heard of prior to the start of the Paris Olympics, triggered. In a flash, market perceptions changed from Softilocks to the consideration that maybe the Fed has overstayed its welcome, like a surprise weekend visit from an uninvited houseguest, and that a recession is all but a foregone conclusion.

Figure 2: This Just In: Bad News is Bad Again

Source: Piper Sandler

Very intelligent, skilled economists and strategists continue to debate whether a recession will occur, but they all tend to agree that the odds of one happening soon have increased given the latest check on labor markets. Our view remains that it is much more likely that a recession will occur than not.

Recall that monetary policy changes take a long and uncertain amount of time to reveal their full impact on the economy. Another way to think about the concept is that trends and momentum take considerable time to change course. Regardless of if the Fed cuts rates in September or not, we expect the unemployment rate will continue to climb over the next several months, potentially rising to near 5% by year-end.

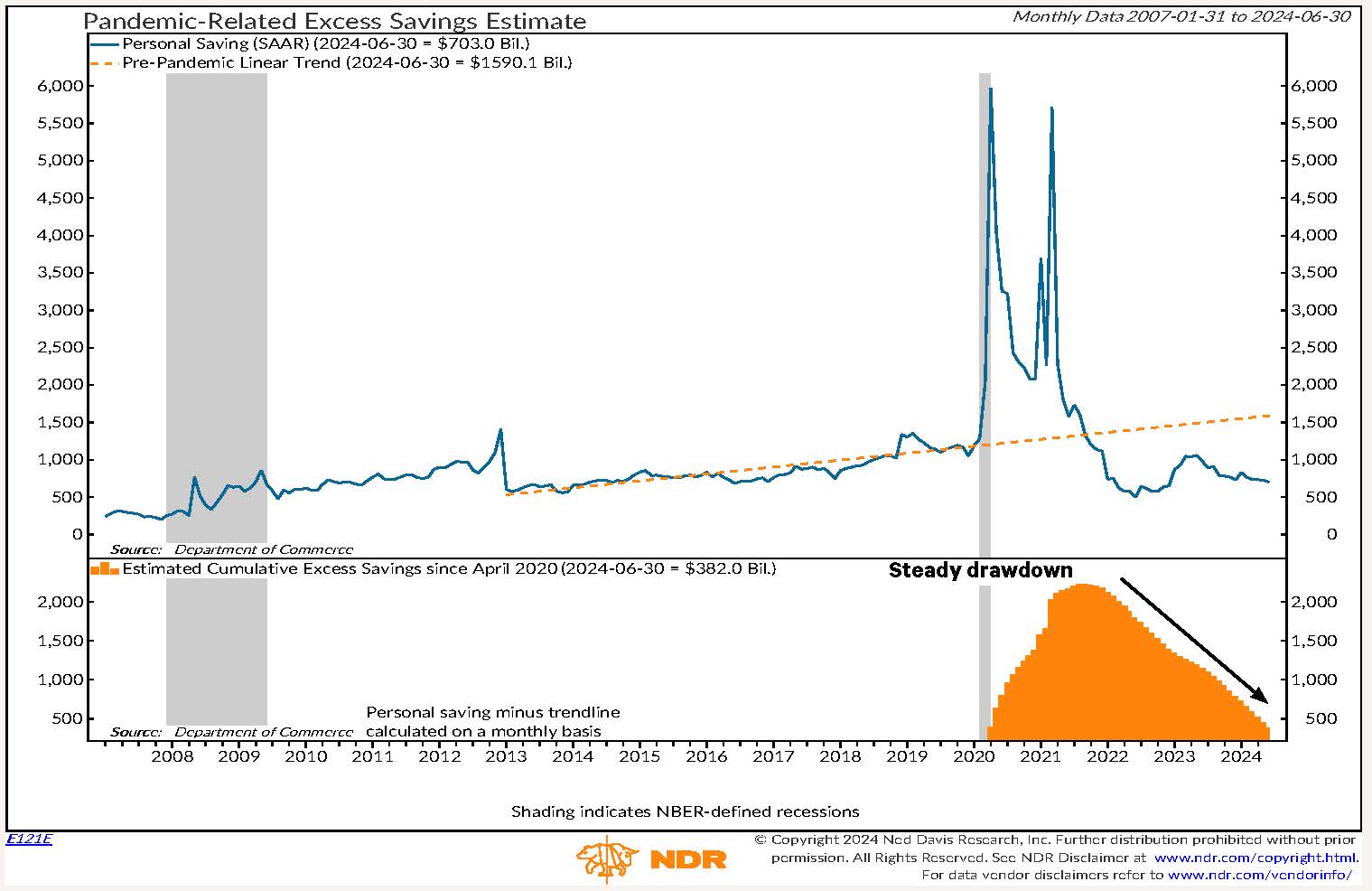

A higher level of unemployment doesn’t necessarily imply a recession, so much as the rate at which it gets there and then of course, the decline in associated consumer spending that invariably goes along with it. While headline news continues to tout the strength and resilience of the US consumer, anecdotal evidence continues to build about troublesome fraying at the margin. We have highlighted in past writings about rising credit card balances, delinquent payments and rising defaults – these trends are continuing to get worse as the increased levels and cost of debt are taking their toll. It took a while, but stimulus money is all but gone and the past years of inflation have eroded the real purchasing power of the lower and middle classes substantially. From a peak level of $2.2T in Q3 of 2021, aggregate excess savings have run off by roughly $56B per month, declining to only $382B just 36 months later. There’s not a lot of juice left in that lemon.

While there is a clear bifurcation amongst the cohort of higher wealth consumers and those in the lower income/wealth brackets, even the upper tier is starting to blink. Travel and leisure providers are reporting softening demand and more discerning bargain hunting by even their wealthiest of customers.

Figure 3: Excess Consumer Savings Officially Depleted

Source: Ned Davis Research

It’s clear that the current economic backdrop is playing a central theme in the upcoming Presidential election, as each side blames the other for high prices, less disposable income and growing job instability. While there are a myriad of issues and policy stances that are of various importance to each voter, it looks highly likely at this point that the election will be an extremely close race. Historically speaking, a poor economic backdrop has not been kind to the incumbent party, but by no means is that statistical track record a predictive lock for this cycle, given the extreme polarization across our country.

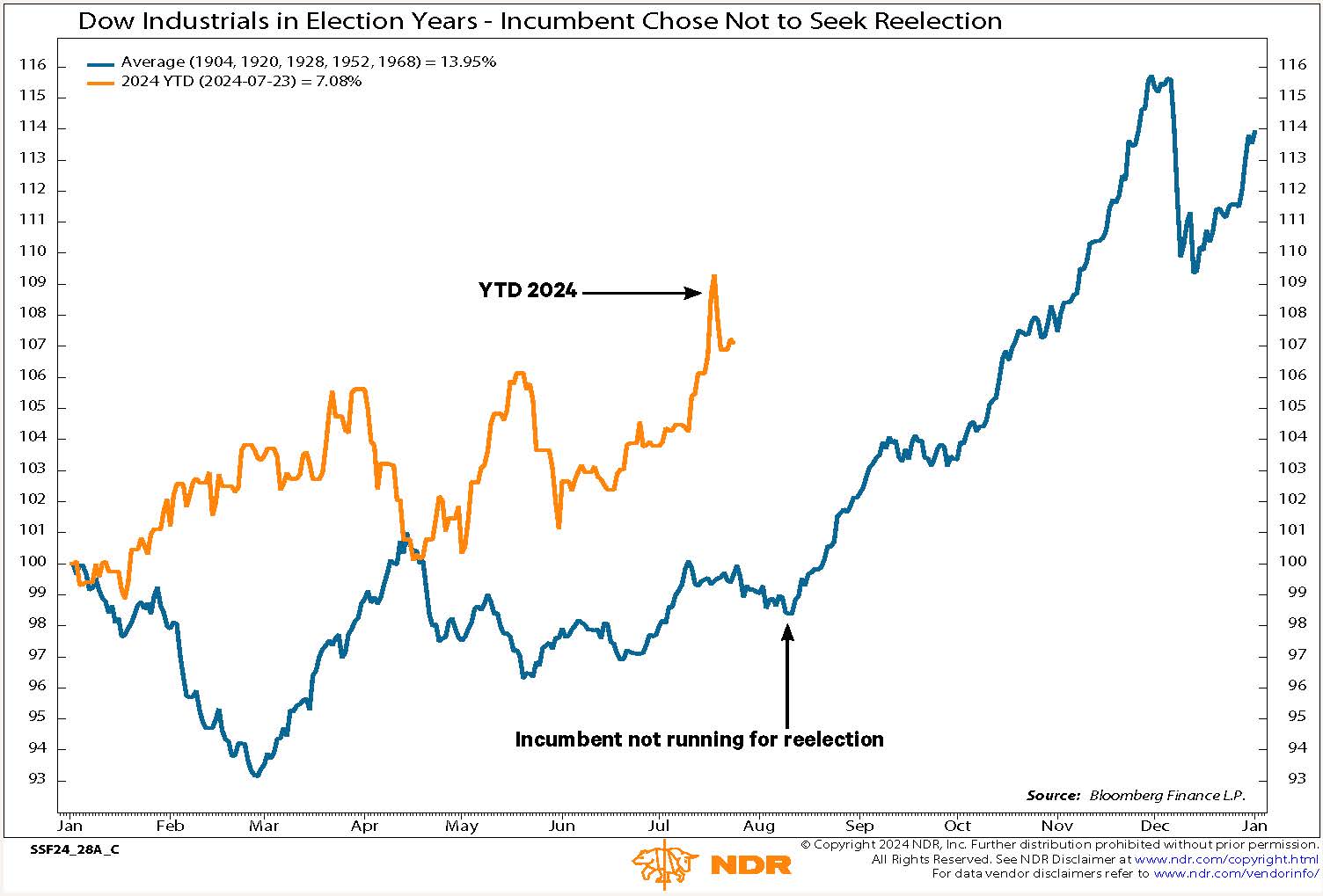

While the change in Presidential candidates this late into the election cycle is highly unusual, it is not unprecedented. Understandably, investors can get concerned with the inevitable volatility surrounding election cycles, but again, history suggests that election years tend to deliver more positive returns than not, even in the rare instances when there is a change on the electoral ticket.

Figure 4: Presidential Cycle, Even With A Swap, Suggests 2H Equity Market Rally

Source: Ned Davis Research

While there is likely to be some short-term volatility, election results rarely tend to have a long-term impact on the path of the markets. Earnings, inflation expectations, monetary and fiscal policy all have a much greater influence than politicians on stock, bond and real asset markets, and the future, as hard as it might be to believe, looks relatively decent in terms of forward returns.

Q2 earnings have held up remarkably well, notching an average positive surprise of over 5%, with 72% of the S&P 500 reporting to date. (Of note, technology and financial companies continue to show extremely durable profitability with average earnings beats of 28% and 13% respectively.) Inflation expectations remain well-anchored. It is a matter of when, not if, monetary policy will become less restrictive and fiscal policy is likely to remain uber-accommodative regardless of which party wins the election.

We continue to adhere to the disciplines of maintaining asset allocations that are driven by our clients’ financial plans, while ensuring that our clients are responsibly exposed to key trends and opportunities that are impacting our collective future. Although some of the price action in the AI and technology space has re-rated lately, we believe these are durable secular trends that offer a unique and compelling chance to invest in burgeoning areas of growth.

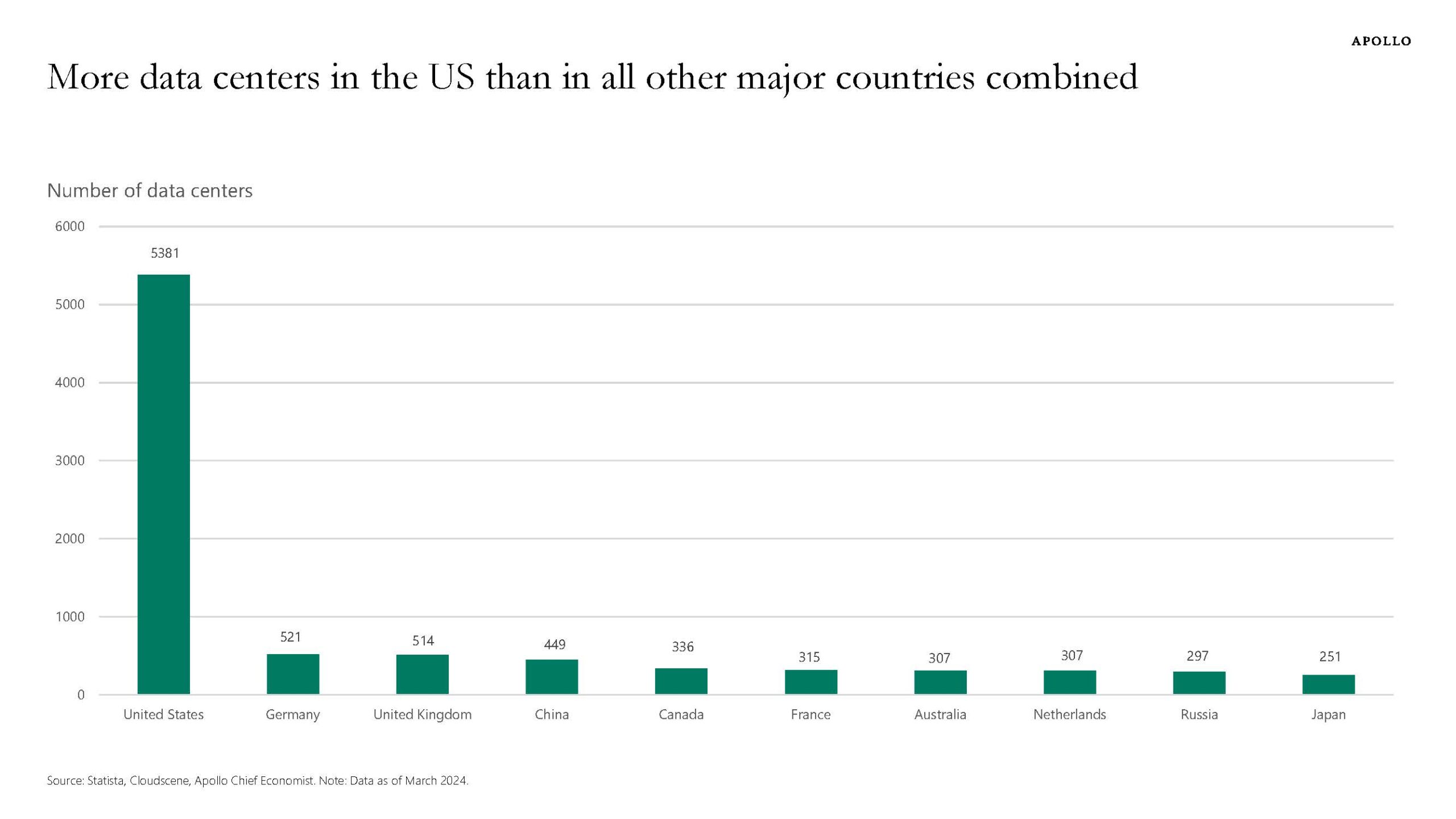

Figure 5: Coming Soon to a City Near You: Data Center(ic)

Source: Apollo

From an asset allocation perspective, our portfolio models are at full strategic weight to public equities, with a tilt towards large cap domestic stocks. We continue to lean towards higher-quality companies across our equity allocation, regardless of region or market capitalization. For our Qualified Purchaser clients, we are bringing compelling ideas and structures to invest in private equity.

In credit, our preference is for a neutral duration and higher quality bias, and we expect lower-rated debt to be challenged as the economy continues to slow. Where appropriate, we have a full allocation to large cap, defensive private credit to complement our public fixed income selections.

Our real assets exposure is fully allocated to gold and where appropriate, private global infrastructure and private real estate. Within our private real estate, we have built a meaningful exposure to pure-play data centers, industrial and student housing.

Our Capital Insights readership continues to grow and encompasses clients, prospective clients, strategic partners, as well as friends of our firm. To our clients, we deeply appreciate your business and trust in your Capital Planning Advisors team. If you are not a client and are contemplating initiating a relationship with us, either directly with your personal or business assets, or by referring someone you think could benefit from our services and approach, we would be delighted to speak with you.