Yet another gut-wrenching day in the equity and credit markets as volatility has now exceeded levels not seen since 2008. Clearly, our daily lives are morphing in response to the domestic and global efforts to mitigate the spread of the virus, and policy responses are updating seemingly by the hour. Given the dizzying array of changes, we thought we would offer a few thoughts for your consideration.

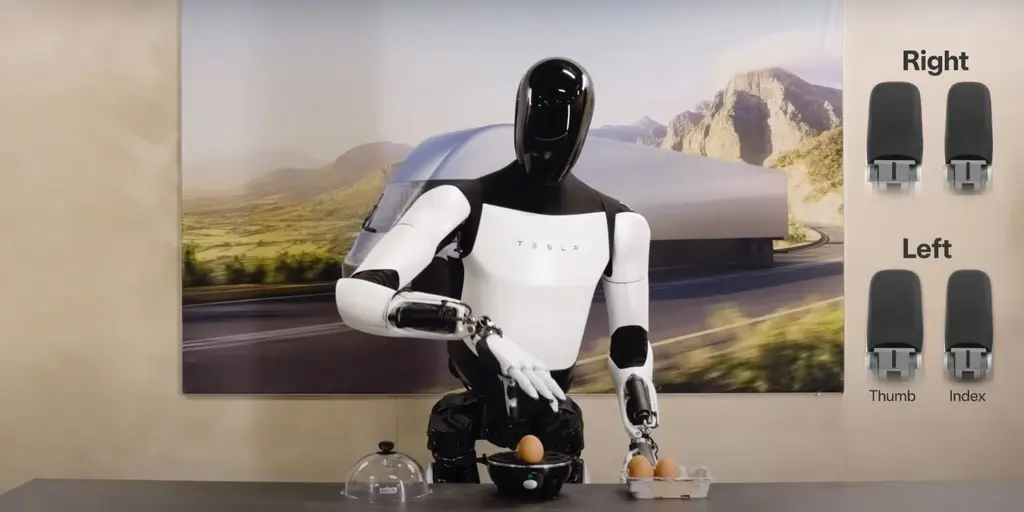

Figure 1: Whiplash – High Yield Spreads and the VIX (Volatility Index) Spike

Source: Cornerstone Macro

- The Fed (and other global central banks) have acted and are coordinating to ensure liquidity and properly functioning money, credit and equity markets. Without getting into technical details, the Fed has dusted off its playbook from 2008 and is addressing market dislocations with much greater speed than in the past financial crisis. They understand their need to demonstrate their role as lender of last resort and have answered the call much more quickly this time.

- Massive fiscal stimulus will help, but odds of recession are rising, and markets are pricing in that outcome. Consumer confidence has declined dramatically in the last two weeks as closures and shelter-in-place guidance is rippling through the economy. The longer it takes for the virus to stop spreading and for people to get back to their normal lives, the deeper the economic impact. Fortunately, consumer savings rates and debt service levels are much healthier than the last go around, and low rates and government consumption are offsets to the forthcoming declines in consumption and capital expenditures.

- This is a not a financial crisis, it is a public healthcare emergency. We understand that this volatility can be distressing, but we believe it is important to compare and contrast the causes behind it. There is plenty of capital in the banking and financial system; the market concerns stem from trying to measure the ultimate economic impact of this latest pandemic. In fact, over 70% of daily market volume is coming from algorithmic trading as leveraged ETFs and index investors are forced to rebalance to index compositions at the end of each day. There is a tremendous amount of noise in the markets right now, which will eventually die down.

- Finding a market bottom is an unpleasant process. In every bear market, regardless of the underlying causes, there are multiple signals and signs that help identify when it is safe to deploy and reallocate capital. (Hint: it’s not right now). Our team has managed money for clients through the multiple bear market cycles since the 1990’s and remain focused on studying the markets and taking prudent and proper action when the data indicates it is safe to do so.

- The time to make significant financial decisions is NOT during market panics. We’ve written about this before with many investors feeling the need to DO something…anything…just DO something! If you are invested, it is not the time to change course. If you have cash right now, it’s time to be patient. We’ve seen time and time again when emotion causes investors to sell out, lock in losses and do the exact wrong thing at the exact wrong time. This happened to many people in 1998, 2000, 2008, 2011, all who regretted their decisions afterwards. Check with your relationship manager and revisit your strategic financial plan. Ensure you have enough cash and liquidity for your next few months of expenses as we expect this volatility to persist until there is more clarity about a solution for this healthcare issue.

- We are currently working on portfolio updates and ideas for the post COVID-19 environment. As we have previously mentioned, we de-risked client portfolios in Q4 of last year and implemented those changes through client accounts soon thereafter. We are currently evaluating high quality investments that have just gotten a whole lot more attractive from a valuation perspective in the last two weeks. Companies and industries with strong free cash flow, stable balance sheets, quality management teams and secular growth opportunities. We are also monitoring and evaluating managers that are holding up extremely well in this downdraft. When the time is more appropriate to rotate into our post-event ideas and vehicles, we will do so.

- This too, shall pass. We understand how difficult conditions are for many people right now. Times are bizarre and a bit scary for everyone. Undoubtedly there are more difficult days ahead, but there are some nascent positive signs that are emerging from China that will hopefully serve as a harbinger of better days to come. Try not to focus too much on the markets. Financial asset values look poor right now but they WILL recover as we gain the upper hand on this pandemic. When that happens, risk-on will likely return in a big way and we will have our clients positioned to benefit. Stay healthy and be well.