Like the series of atmospheric rivers that pummeled California over the last several weeks, the Fed and other central banks’ aggressive constriction of monetary policy wreaked havoc on the markets last year. While it is understandable that most investors would certainly like to bid last year a good riddance, it is worth reflecting for a moment on just how challenging the market and economic environments were.

Collectively we witnessed a record policy reversal from easing to tightening in 2022 as central bank officials tried to contain the inflation freight train roaring and rumbling through our interconnected global economy. The Fed stomped on the brakes hard, raising rates by over 4% in just one year, one of the fastest and steepest sets of rate increases in modern history. Between the valuation compression caused by rising rates and general risk aversion, price multiples collapsed in virtually all asset classes, marking the first time in history that both stocks and bonds suffered a double-digit decline in a single calendar year.

Figure 1: Both Stocks and Bonds Declined by Over 10% in 2022

Source: Ned Davis Research

Elevated geopolitical risks stemming from the Russian aggression in Ukraine continued to contribute to the myriad of challenges keeping a bid under energy prices and a preference for haven assets in an uncertain and inflationary world. Indeed, the only positive public-market returns to be had in 2022 were found in commodities (largely driven by Oil), the US Dollar, T-Bills and Gold. Everything else? Notsomuch.

Figure 2: Oil, Cash and Gold Bullion…The Apocalypse Portfolio Wins in 2022

Source: Ned Davis Research

Concluding our stroll down the Not-So-Great-Memory Lane of 2022, investors are left looking into the start of 2023 and asking, “what happens next?” While the markets have diverged from Mother Nature and have gotten off to a sun-shiny start in early January, our forecast unfortunately calls for more rain and stormy weather ahead.

Last year’s market story was all about rising rates, and we suspect this year’s market story will prove to be all about declining earnings. It takes several quarters for the impact of a higher cost of money to work its way through the economic transmission system and we believe the full extent of the damage has not yet been felt. Simply put, higher rates result in higher input costs, which increases pressure on margins, which results in lower profits.

Typically, the highest cost in any business is people. Corporate managers understand this fact and will work to increase efficiencies and protect profit margins by reducing headcount. Already we have seen several high-profile layoff announcements and we expect them to continue over the course of this year.

Recall that the Fed’s dual mandate is price stability (contain inflation) and maximum employment. What is not so clear to many is that “maximum employment” does not translate to “no unemployment.” There is always a structural level of unemployment in any economy as labor moves from one segment to another and as people enter and exit the workforce. What makes this situation so challenging for the Fed (and other central banks) is that the labor market is still too hot and wage inflation is still too high. Why is wage inflation such an important measure to follow? Because if consumers feel like they are making more money in nominal terms, they keep spending elevated (aggregate demand), even if they aren’t necessarily keeping up on real (inflation-adjusted) terms.

Consumption and spending habits change slowly, especially after nearly 15 years of essentially free money. Indeed, we are seeing this pattern play out once again even as inflation has decimated real purchasing power over the last year and Covid-era stimulus money has been all but depleted. We are now seeing credit card balances rebound in dramatic and unnerving fashion, even as card interest rates spike.

The only way to cool wage inflation is to balance supply and demand in the labor market. Supply remains too tight as the Unsolved Mysteries of the long-Covid, quiet-quitting disappearing labor force continues to stymie hiring and HR managers everywhere. We are guessing that even Robert Stack couldn’t figure out where all those people went. Regardless, that leaves the Demand-side of the equation, and that’s precisely what the Fed can impact through maintaining a higher-rate regime.

We do not expect a Fed-pivot this year, in fact, quite the opposite. The Fed needs to engineer further demand destruction in the labor market, which will cool wage growth and thus, cool overall consumption, which will help cram the inflation-genie back into the bottle. And that won’t be easy. How far they slow the economy, and for how long, is anyone’s guess, but we suspect that monetary policy will be tighter for longer than most expect and that a Recession is virtually unavoidable.

Reading the economic tea-leaves is a whole lot easier using the HOPE framework, cleverly authored by our macroeconomic research partners. While we have written about this construct in the past, we show the model in a different format below, and indeed, we are seeing the script play out once again. Housing peaked in 2020, Orders in 2021 and Profits in 2022. Will 2023 prove to be this cycle’s peak in Employment? Logic says yes.

Figure 3: We’ve Seen This Movie Before and It Doesn’t End Well

Source: Piper Sandler

Source: Piper Sandler

We believe that markets have been so focused on the Fed and the hopes of near-term pollyannish pivots, that they haven’t yet contemplated the declining earnings story. Though earnings estimates have started to come down, we don’t think they have come down nearly enough to account for the massive amount of tightening that has just occurred. On a positive note, we do think it is reasonable to conclude we have seen peak inflation, as we have seen CPI recently decline from a 9.1% annual growth rate in June down to 6.5% today, but we believe inflation will be more persistent and elevated than the markets are currently pricing in.

It’s not very much fun to write about challenging outlooks ahead, but as professionals and as fiduciaries, we look at the weight of the evidence, develop a logical thesis and call it as we see it. Many sell-side firms are much more optimistic on 2023 market returns than we are, but we just aren’t seeing the sort of catalyst that would help create a sustainable new Bull cycle just yet. Perhaps our view is a bit too pessimistic, but we aren’t quite ready to believe the difficulties are all behind us at this point.

Figure 4: Wall Street Price Targets Are All Over the Board

Source: Trahan Macro Research

Source: Trahan Macro Research

It’s human nature to be optimistic and expect better times ahead. Indeed, we are optimists and we do see better times ahead, too…but not just yet. In any Bear Market, there are several head fakes that typically occur. We have seen our share over the past year and expect more to present themselves as we progress in 2023. Predicting market bottoms is notoriously difficult, but they align well with bottoms in Housing and PMI data, on which we are keeping a close eye. Unfortunately, both continue to decline and look to fall further as we progress into this year before finally settling out.

Figure 5: Grrrrrr…Don’t Take the Bait

Source: Ned Davis Research

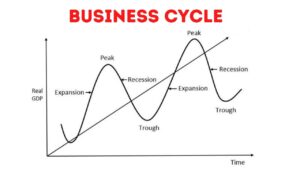

With the NFL Playoffs now upon us, we cannot help but to be reminded of the quote, “offense wins games and defense wins championships,” and that is exactly how we have positioned our clients’ portfolios. In a slowing economy and choppy market on its way to finding an ultimate bottom, we continue to move up-quality in all asset classes and play defense where possible as we move through the troughing phase of the economy. Critically important is to keep a longer-term view though, because after every Trough comes a Recovery and those tend to be very powerful.

In our equity profile, we have focused on sectors that have pricing power, lower market sensitivity and on companies that have strong and growing earnings power. In fixed income, we are avoiding credit risk as we expect credit spreads to widen later this year; we are also anticipating signals that it will soon be time to extend duration as markets price in lower growth ahead. For the first time in a long time, investors are getting paid reasonable cash flows on their fixed income holdings. Where appropriate, we continue to increase client allocations to premier institutional Private Capital vehicles that can take advantage of these market dislocations. These strategies have been benefitting substantially from higher inflation and higher rates and are generating significant cash flow for investors. Lastly, we are maintaining a healthy allocation to liquid alternatives to help reduce volatility and extend portfolio capabilities to capture a broader set of returns.

Figure 6: We’ve Got to Trough Before We Recover

Source: Piper Sandler

Source: Piper Sandler

While we expect a difficult market environment in 2023, we are confident that there is a rainbow on the other side of this storm. Our team has guided clients through several challenging market cycles over the last three decades and we will do so again this time as well. We appreciate your trust in our professionals and your confidence in our process. We are here for you and if you have any questions or concerns, please don’t hesitate to reach out to your Relationship Manager.

Our Capital Insights readership continues to grow and encompasses clients, prospective clients, strategic partners, as well as friends of our firm. To our clients, we deeply appreciate your business and trust in your Capital Planning Advisors team. If you are not a client and are contemplating initiating a relationship with us, either directly with your personal or business assets, or by referring someone you think could benefit from our services and approach, we would be delighted to speak with you.