1983 was thirty-eight years ago. 1983, seemingly innocuous, was a rather remarkable year as 106 million viewers tuned in to watch the final episode of M*A*S*H and Star Wars: Return of the Jedi was released into theaters. David Bowie’s Let’s Dance hit the top of the US billboards and Michael Jackson’s iconic music video, Thriller first appeared on MTV. Congress recognized Martin Luther King, Jr. Day as a national holiday. Ronald Reagan announced that GPS, formerly reserved for military use, would be made available to the public, and Sally Ride became the first American woman to launch into space. In 1983, crude oil traded in the $30’s, Gold was near $500/ounce, 10-year Treasury rates were around 11.8% and the S&P 500 index hovered around 166. 1983 was also the last time we have seen an economic recovery as strong as we have had in 2021.

Figure 1: Our Economy Has Seen the Strongest Recovery since 1983.

Source: Cornerstone Macro

Last quarter we wrote that reopening the global economy was going to be no easy task and that we expected several fits and starts in the process. Admittedly, that was not one of our more insightful or heroic prognostications, but it has been amazing to witness the knock-on effects of flipping on the planet’s “Go-switch.” Question: What do you get when you combine the perfect storm of pent-up consumer demand, massive fiscal and monetary stimulus, lingering supply chain snafus and thousands of workers voluntarily liberating themselves from their jobs to embrace the global YOLO (You Only Live Once) mindset? Answer: Soaring prices at gas pumps and restaurants, empty shelves at Costco and grocery stores and sold-out inventories of new and used cars, Rolexes and most other luxury goods at the shopping mall. It is no small wonder that the global economy has continued to lurch and stumble forward as well as it has to date.

Remember those concerns around secular stagnation or even (gasp!) deflation? That’s soooo 2019, dude…get with the times. These days, the question of INFLATION is squarely on everyone’s mind – specifically how much and for how long? While we don’t enjoy paying higher prices for seemingly everything just like everyone else, we maintain our view that many of these recent price spikes should start to recede to more normal levels as we move towards the middle stages of our recovery. Indeed, we are seeing some early signs of supply chain improvement, which in turn should help lower price pressures going forward.

Figures 2 and 3: Better Supply Chain Management Leads to Lower CPI Forecasts

Source: Ned Davis Research

Source: Cornerstone Macro

The labor markets are healing nicely as well. Though persistent and lingering COVID outbreaks will continue to disrupt certain countries and industries, we are heartened by the trends we are seeing in labor force participation, overall unemployment levels and productivity. Increasing productivity allows businesses to absorb most wage inflation pressures, preserving margins and ultimately earnings. So even though some nominal wage inflation is occurring, we don’t see a large risk to overall corporate earnings and thus stock market prices. In a consumption driven economy, one could make the case that after years and years of nominal and real wage stagnation, a little wage inflation is not necessarily a bad thing.

Figures 4 and 5: Improving Labor Markets and Productivity Help Keep Wage Inflation Reasonable

Source: Cornerstone Macro

A backdrop of steady economic growth and moderating inflation combined with healing labor markets, improving confidence and easy monetary conditions, would explain why the equity markets continue to grind higher and why bond yields remain rangebound. That backdrop would explain the capital market’s behavior very nicely indeed.

Figure 6: Credit Spreads and Global Conditions Suggest Rangebound Rates

Source: Cornerstone Macro

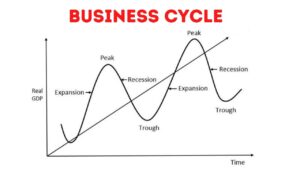

Of course, we are not entirely sanguine to the risk side of the equation. 2020-2021 compressed the typical five-year Expansion-Peak-Contraction-Trough economic cycle into mere 18 months. 2022 will likely bring a new set of challenges as growth slows and the impulse from fiscal and monetary stimulus wanes. Valuations are high in virtually every asset class and we expect increased volatility and lower, but positive, forward returns in the equity markets. Fixed income markets will remain very challenging and now that inflation looks to be back in the fold, real returns in the bond markets will be difficult to achieve.

A large part of our job is to help make sure we provide our clients proper exposure to secular themes and opportunities that are shaping tomorrow’s economy. To paraphrase the famous hockey player Wayne Gretzky, we are skating to where the puck is going to be, not where it has been. Our investments into Private Real Estate, Credit and Equity have both provided compelling returns as well as lowered overall volatility risk in client portfolios. And while our investments in Innovation, FinTech, Genomics and Clean Energy have not repeated last year’s outsized returns, we continue to believe they will yield long term benefits as they become greater and greater contributors to our GDP growth.

Figure 7: Eyes Forward and Skate to Where the Puck Is Going Be

Source: Cornerstone Macro

While it may be difficult for some to remember what life was like back in 1983, most of us likely recall what life was like back in 2008 at the onset of the Global Financial Crisis (GFC). As many know, the GFC and the resulting quantitative easing policy actions set off a thirteen-year run of disinflation, debt and declining interest rates. Has the burgeoning economic recovery from 2020’s shutdown finally created a pivotal turning point in economic and market history? Only time will tell.

Figure 8: What a Long, Strange Trip it’s Been

Source: Fidelity Digital Assets

Our Capital Insights readership continues to grow substantially and now encompasses clients, prospective clients, strategic partners, as well as friends of our firm. To our clients, we deeply appreciate your business and trust in your Capital Planning Advisors team. If you are not a client and are contemplating initiating a relationship with us, either directly with your personal or business assets, or by referring someone you think could benefit from our services and approach, we would be delighted to speak with you.

We continue to experience steady and stable growth and we are grateful that everyone on our team is healthy and safe. We sincerely hope that you and your loved ones are keeping well and please do not hesitate to contact us if you have any questions or if we can be of further assistance.