It is hard to believe that 2023 is already one-third over. Indeed, each year seems to continue to pass by faster than the last and in terms of market surprises, the first quarter of this year did not disappoint. Predicting the Q1 rip-roaring rally in tech stocks combined with the spectacular failure of several high-profile regional banks highlights that even the most unpredictable set of events can occur in the short-term, while the most predictable series of events continue to play out just as expected over the intermediate-term.

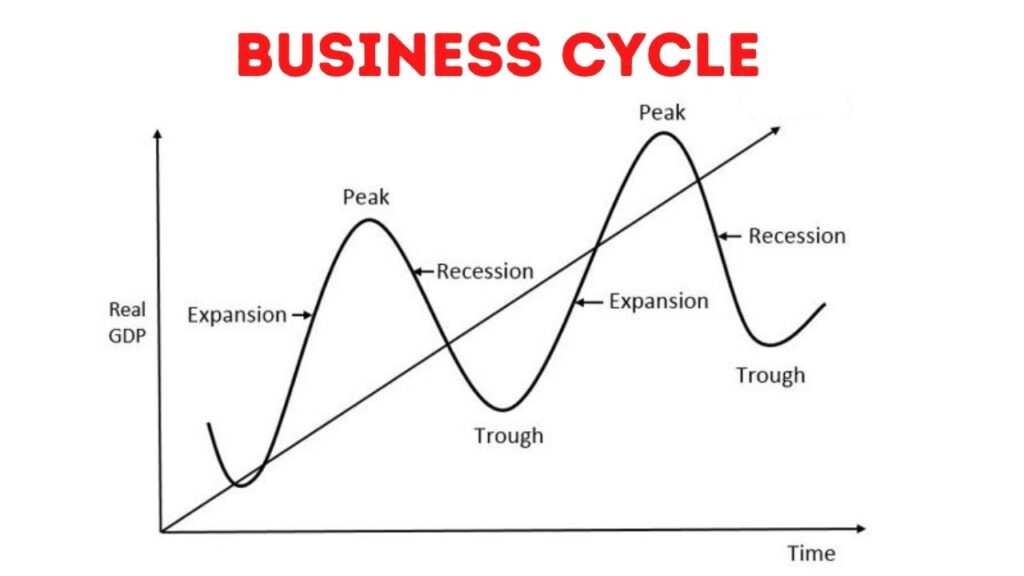

For those readers who prefer to get straight to the point, this quarter’s Capital Insights’ bottom line is this: nothing has changed in the longer-term trajectory of the markets and economy. Inflation, while slowing, is still too high; the labor market, while showing some initial cracks, is still too tight; the global and US economy, while slowing, is still growing; and central bankers, having tightened monetary policy, still have more work to do. As the header graphic illustrates, we believe we are somewhere on the downslope from the Peak and heading towards Recession. Where we are on that curve is anyone’s guess, but our best data currently suggests that we will have arrived in R-town towards the end of this year or the beginning of next.

Figure 1: All that Glitters is Tech and Gold in Q1

Source: Ned Davis Research

Predicting recessions is particularly tricky stuff, and best saved for those Economists and lauded Thought Leaders well-practiced in those dark econometric arts. We make no claim as to the precision of the timing of our call, but we are highly confident of the direction in which we are heading.

As written before, a recession in and of itself is nothing to necessarily fear, it is simply something for which to prepare. Certainly, economic contractions are not without costs, and we empathize with those industries, institutions and individuals that are forced into difficult decisions and adjustments as we have moved on from the relative ease of an inflation-less and zero-interest rate policy world.

The Fed just completed its 10th sequential rate hike this past week and we remain puzzled at the equity market’s disbelief at the stated policy stance that Chair Powell & Co. will keep rates elevated until inflation reaches much more satisfactory levels. Yes, we understand that the Fed lost significant credibility with the whole “Transitory” episode, but this fact is exactly why we think the Fed sticks to their guns this time around – they need to earn back their credibility with the markets. The bond markets are pricing in slower growth and slowing but sticky inflation; the equity markets are pricing in rate cuts by the end of the year. Which sounds more plausible to you?

Figure 2: Equity Markets Pricing in 100 Basis Points of Rate Cuts by Valentine’s Day 2024

Source: Piper Sandler/Bloomberg

With all due respect to any economist who might be reading this article, we prefer to break down a bunch of economic mumbo-jumbo into this simple statement – labor costs are still too high. When there isn’t enough labor, employment costs and personal incomes rise, and people spend more money and drive prices of everything higher. Higher labor costs also put downward pressure on corporate profits if companies cannot pass price hikes through to end consumers. Central banks tighten monetary policy to cool consumption and this cycle continues until companies must start laying off workers to protect their profits, creating slack and equilibrium in the labor market.

Figure 3: You Don’t Need an Economics Degree to See the Key Issue Here

Source: Piper Sandler

We have seen this cycle play out over the year as the US and global economies are slowing everywhere. In prior editions of Capital Insights, we have written extensively about the HOPE model, which describes the sequence in which economic data slows over a general timeline. As a refresher, this pattern starts with weakening Housing activity, then moves to slowing new Order growth, then onto declining Profits and concludes with declining Employment. Typically, this cycle manifests itself over the course of roughly two years.

The HOPE model has served as a basis for our overall investment strategy and has allowed us exceptional clarity in an environment filled with volatility and uncertainty. The constriction of monetary policy is absolutely taking effect and we have all collectively witnessed the slowing of Housing, new Orders and Profit declines. This quarter’s earnings surprises were largely positive, but on greatly reduced expectations and we expect continued downward revisions in forward estimates as the lagged effect of rate hikes becomes more pronounced.

Credit conditions are tightening rapidly, which is helping to exacerbate the slowdown. It is often said that credit is the lifeblood of an economy, and we all know that access to capital is critically important for both business and consumers. Bankers, in addition to being generally very nice people, tend to be smart as well and must do their best to make sure they get paid back on the loans they are making. When forward conditions look a little rough, they tend to get very conservative very quickly, which is what we are seeing happen in real time. So far credit spreads (the extra cost borne by lower creditworthy borrowers) have remained relatively contained, but these tend to widen quickly in times of market stress.

Figure 4: Stealth Tightening…Tighter Bank Lending Standards

Source: Carlyle

As mentioned in previous writings, we believe the next chapter to unfold in the cycle is a weakening employment market despite the strong jobs numbers that were reported this past week. However, looking under the employment market hood a bit more, there is a clear pattern of a weakening trend in claims, average hours worked, job openings and temporary employment. Unfortunately, we expect this trend to continue as the layoff numbers continue to grow.

Figure 5: Unemployment Level is Tight…For Now

Source: Bloomberg

As the employment market softens, we would expect consumer spending to continue to contract, as excess savings are depleted. We expect credit conditions to remain tight and perhaps tighten even more as the economy nears stall speed before slipping into negative growth territory later this year. So far, the markets have priced in a low risk of contagion from current regional banking issues, but as history has taught us all, we cannot be certain that we are immune from additional Black Swan events, and we will just have to wait and see what unfolds from this new regime of inflation and a higher cost of money. Be prepared for more volatility in the markets as we move forward in the cycle.

Figure 6: From the H to the O to the P, get ready for the E

Source: Piper Sandler

As we have cautioned clients before, it is economically dangerous to focus too closely on short-term events and near-term doomsday boogeymen that may never appear. Longer term, economies, profits and standards of living all grow and we are fortunate to live in a resource-rich country that has strong demographics, rule of law and the strongest and best capital market system in the world. We are still bullish on America and the markets.

Strategic asset allocation is a wonderful tool that can help soothe frayed nerves in a volatile market environment and ensure client portfolios are properly aligned with long-term financial plans. Diversifying portfolio assets across types, size, and liquidity is also critical to helping ensure our clients have the highest probability of success in their individual plans as well.

Figure 6: Eco Cycle From Another Lens

Source: Ned Davis Research

Tactically, we have made a few changes over this past quarter: we have slightly lowered our equity allocation and within it, continue to buy companies with higher Quality metrics, such as more stable earnings power, lower debt ratios and more durable business models. We have increased our fixed income allocations and have increased sensitivity to falling longer-term interest rates as we believe inflation expectations will remain muted and growth will continue to slow. We also have increased our real asset exposure with the expectation that while inflation is slowing, it will eventually settle in at a higher structural level and remain there. Lastly, where appropriate, we have reduced our liquid alternatives holdings in favor for increased allocation to private real estate and credit vehicles which we believe are primed for success in this environment.

Though we expect the next few quarters to be choppy, we are reminded that markets are forward-looking instruments and will start to price in a recovery long before the economic data presents itself as such. Because of this forward-looking nature, it is important to remain invested and stick to the long-term plan. We appreciate your trust in our professionals and your confidence in our process. We are here for you and if you have any questions or concerns, please don’t hesitate to reach out to your Advisor.

Our Capital Insights readership continues to grow and encompasses clients, prospective clients, strategic partners, as well as friends of our firm. To our clients, we deeply appreciate your business and trust in your Capital Planning Advisors team. If you are not a client and are contemplating initiating a relationship with us, either directly with your personal or business assets, or by referring someone you think could benefit from our services and approach, we would be delighted to speak with you.