The scoreboard for 2025 has been anything but dull. Tariffs, OBBBA and AI, Oh My! After a strong opening to the year, momentum has slowed as stubborn inflation and moderating growth have reminded us that economic recoveries rarely move in straight lines. In recent months, the term “stagflation” has returned to the headlines – a label that, while catchy, oversimplifies the reality on the ground.

Growth has cooled but remains positive. U.S. and China’s quarterly GDP growth is tracking near 1%, while the Eurozone remained flattish. Inflation, however, remains sticky, particularly in core services, underpinned by steady wage growth and the capital requirements of the global energy transition.

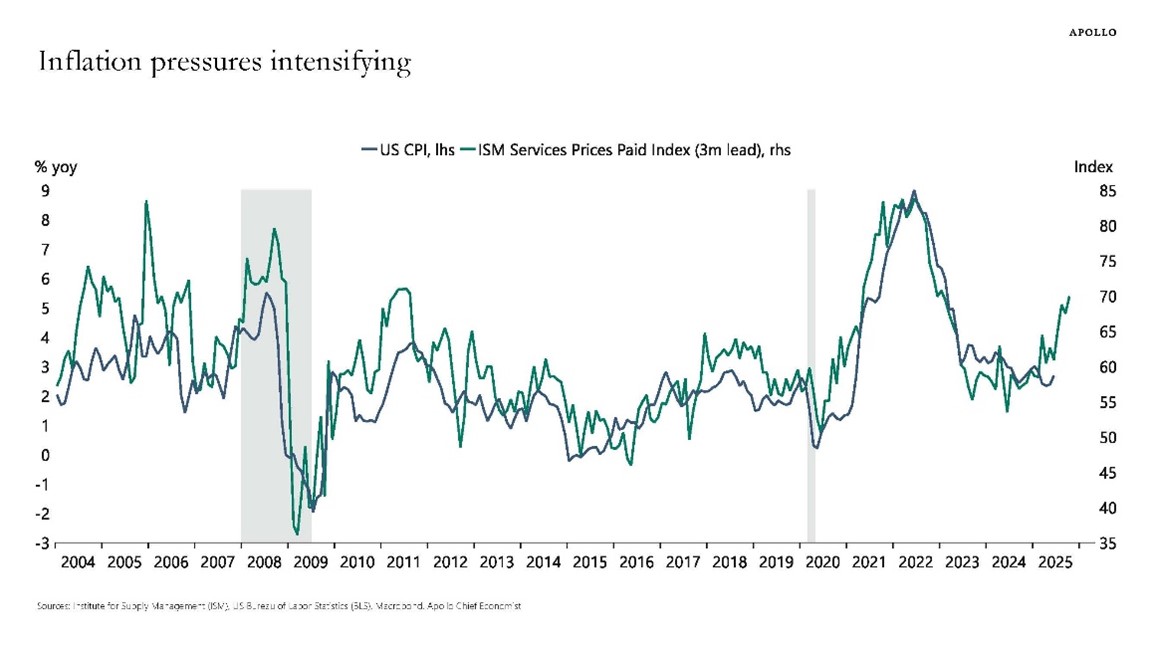

Figure 1: Econ 101: CPI is a Lagging Indicator, ISM is a Leading Indicator.

Source: Apollo

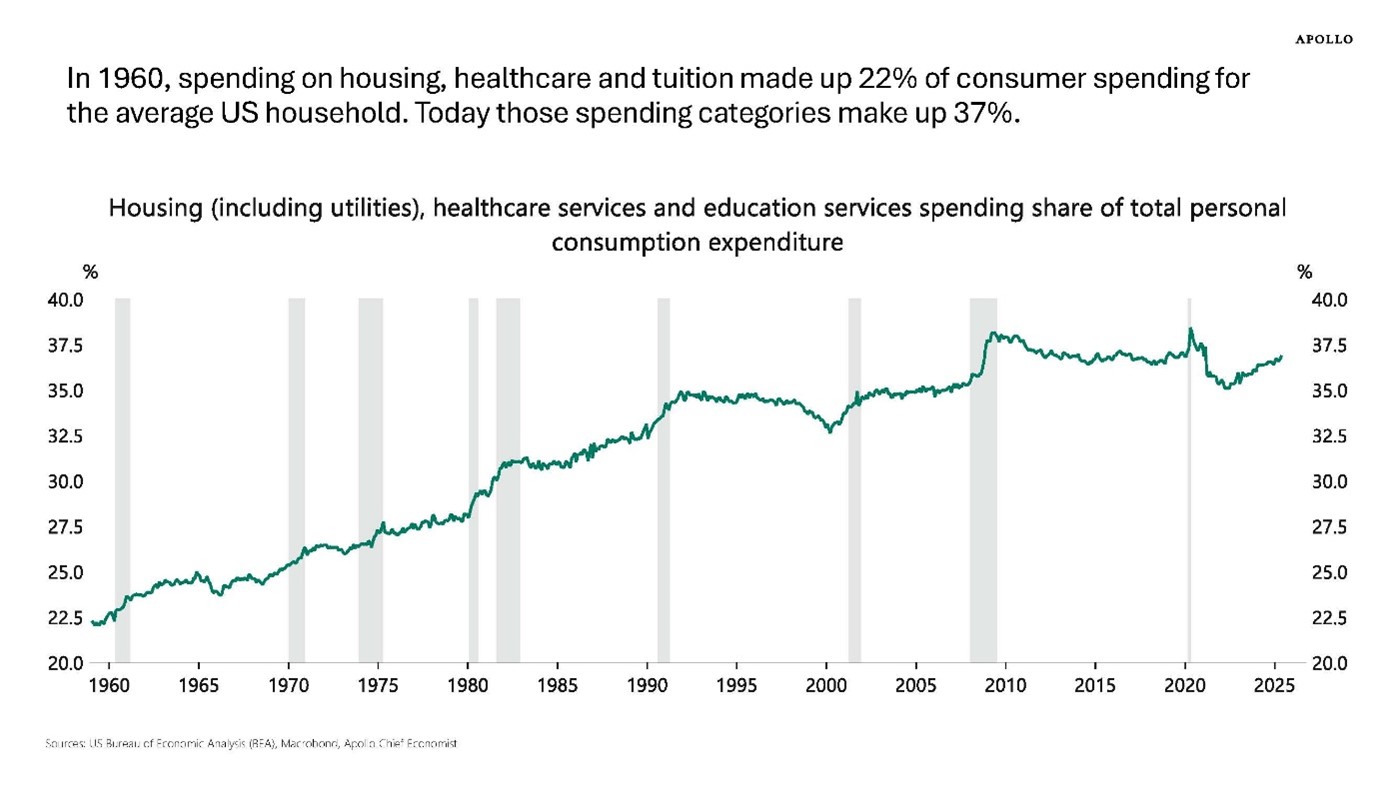

Structural forces, including supply chain reshoring, deglobalization, and new trade barriers are contributing to the persistence of price pressures, making the Fed’s path to 2% inflation gradual rather than swift. This mix of slower growth and persistent inflation has fed the stagflation narrative. Consumers are starting to feel the effects of higher price levels, which now appear to be entrenched in the economic system. At some point, this condition affects consumers’ marginal propensity to consume.

Figure 2: Flashing Yellow: Non-discretionary Spending as a Percentage of Household Income

Source: Apollo

Yet context matters. The labor market remains historically resilient, with unemployment still hovering near multi-decade lows. Productivity is improving as firms adopt automation, digital platforms, and AI-driven efficiencies, leading to measurable output gains despite higher labor costs. Corporate balance sheets are healthy, cash reserves remain elevated, and capital investment pipelines are robust, given some of the recently enacted tax provisions of the OBBBA. This is not the 1970s – there’s no oil embargo shock or collapse in monetary credibility. While the longer-term effects of higher tariffs remain uncertain, they are unfolding against a backdrop of structural economic strength and rapid technological change.

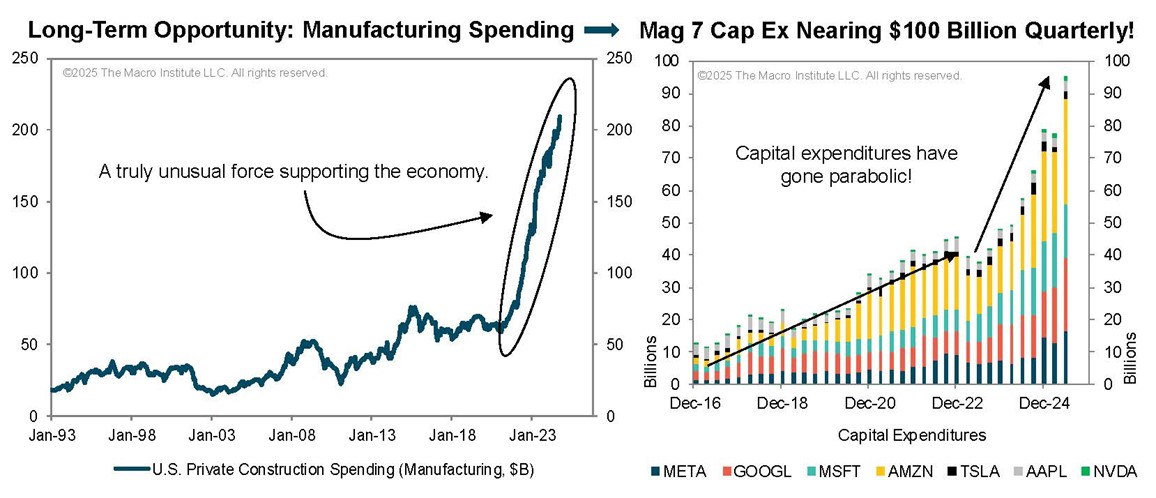

It is well known that consumer spending makes up approximately 70% of GDP and is a key driver of overall US GDP growth. It should be noted, however, that capital expenditures from data center construction contributed roughly the same amount as consumer spending to GDP growth for the first half of 2025. Remarkable, when you think about it.

Figure 3: Technology Capital Investment is Booming

Source: Trahan Research/The Macro Institute

The global picture is equally nuanced. Emerging markets are showing resilience, buoyed by commodity demand and demographic tailwinds, while developed economies are finding growth harder to come by. Energy prices have stabilized after last year’s volatility, but geopolitical tensions continue to add a risk premium to global trade flows.

Despite the short-term volatility, we remain constructive on the medium-to-long-term outlook as several factors should help to keep the economic engine chugging along:

- Corporate Resilience: Low leverage, healthy margins, and operational flexibility provide insulation from short-term macro volatility.

- Technology’s Impact: AI adoption has moved from pilot projects to enterprise-scale integration, boosting efficiency and enabling margin expansion.

- Global Capital Flows: Aging demographics and infrastructure gaps are sustaining investment in healthcare, clean energy, and advanced manufacturing.

- Supportive Policy: Fiscal priorities remain focused on strategic growth sectors like infrastructure, semiconductors, and renewable energy.

- Improving Productivity: The diffusion of automation, cloud-based collaboration, and machine learning tools is lifting output across industries.

These forces are likely to keep the underlying growth engine intact even if near-term data feels uneven.

Markets are juggling mixed signals – cooling growth data on one hand, and resilient earnings on the other. Outside the largest-cap tech names, valuations remain reasonable, and we may be on the cusp of broader market participation. Q3 earnings season has shown strong beats in key sectors, with technology, industrials, and select financials exceeding consensus expectations. We would be remiss, however, to not call out the fact that corporate share buybacks have surged to an all-time high, which helps to support earnings-per-share metrics.

Credit markets remain a source of quiet reassurance. Spreads are stable, and there is no sign of stress in corporate funding markets. This reinforces our view that recession risks are not elevated as economic slowdowns without credit deterioration rarely tip into full-blown contractions.

Investor sentiment is mixed – equity markets are near all-time highs, but long-term interest rates are creeping higher. Cash levels in portfolios are still above historical norms, suggesting dry powder is available to be deployed on market pullbacks. Meanwhile, institutional investors are rotating capital toward real assets and infrastructure, reflecting the desire for inflation-protected returns.

Markets are pricing in rate cuts soon, with two to three cuts before year-end. We are not so sure. Inflation remains above target, and with unemployment still low, the Fed may choose patience over preemption. Rate policy changes take time to influence the economy, a lag measured in quarters, not weeks, and policymakers are well aware of the risk of easing too soon. It will come down to which mandate the Fed values more: price stability, or full employment. Given the concerns about credibility and the forward inflation expectations, we think the Fed still has plenty of rationale to stay the course.

The bar for a policy pivot remains high, and absent a material deterioration in economic data, we can easily see policymakers deciding to hold rates steady. Regardless of what the Fed does next month, we continue to allocate toward long-term secular growth themes:

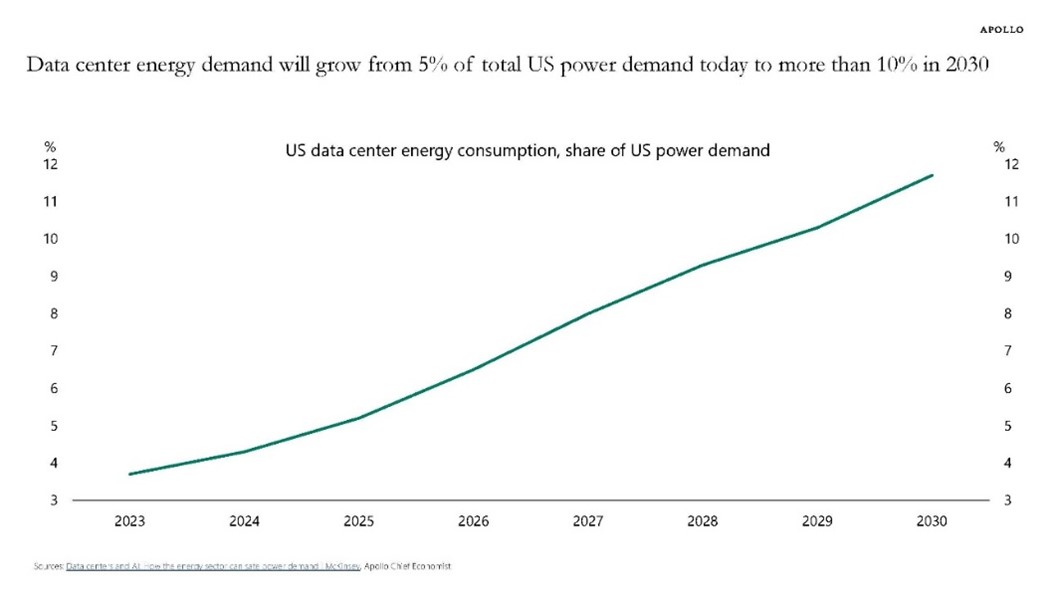

- Data Centers & Digital Infrastructure — The AI revolution’s demand for processing power is driving a sustained buildout of hyperscale facilities.

- AI Across Industries — From logistics optimization to drug discovery, AI is delivering tangible productivity gains.

- Sustainable Energy Transition — Grid modernization, large-scale storage, and low-carbon energy infrastructure are attracting record capital inflows.

- Healthcare Innovation — Advances in personalized medicine, gene editing, and biotech manufacturing are transforming patient care and driving investment opportunities.

Figure 4: Be Like Gretzky: Skate to Where the Puck Will Be

Source: Apollo

Our portfolios remain fully allocated to equities, tilted toward high-quality, large-cap companies with durable competitive advantages. In fixed income, we maintain neutral duration and a preference for higher-quality issuers over high-yield exposure. We continue to see opportunities in selective private market investments for clients, where appropriate. Real asset allocations include gold, private infrastructure, and targeted private real estate, particularly data centers, industrial, and rental housing.

In private credit, we favor defensive, sponsor and asset-backed lending strategies that offer attractive yields without excessive default risk. In private equity and infrastructure, we are focused on managers with sector expertise in technology, healthcare, and energy transition plays.

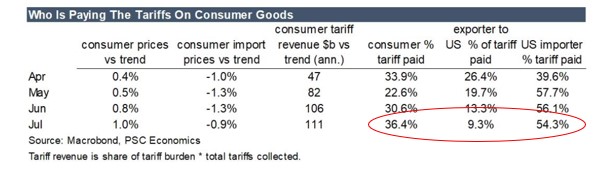

The short-term environment may feel stagflationary, but we see it as transitional. Productivity gains, strong corporate fundamentals, and powerful investment themes offer a supportive backdrop for the long run. The eventual effects of higher tariffs are an open question, but adaptability and innovation remain core strengths of the U.S. economy. As we wrote last quarter, tariffs are a form of a tax and are typically borne by domestic companies or consumers. If importers do not have pricing power, they absorb those higher costs and settle for lower profit margins. Conversely, if importers do have pricing power, those costs are simply passed onto the end consumer. So far, this dynamic is playing out again as higher price levels are now becoming engrained in our economy.

Figure 5: Who’s Picking up the Tab? We Are.

Source: Piper Sandler

We expect periods of volatility, but history suggests such phases often create opportunities for disciplined, long-term investors. Pullbacks can allow us to deploy capital into quality assets at more attractive valuations, aligning with our philosophy of strategic patience and opportunistic allocation.

In short, while headlines will continue to amplify every data release and policy rumor, the underlying story of the economy is one of resilience, adaptability, and progress. Our role is to cut through the noise, maintain discipline, and position client portfolios to participate in the growth that lies ahead.

Lastly, for the past seven years, we have written every single edition of Capital Insights by hand, painstakingly crafting, assembling and revising each word, statistic and nuance. For this quarter’s edition, our goal was to illustrate the point that AI continues to improve and embed itself in our daily lives at an exponential rate. We also wanted to re-emphasize our belief in how important it is for our clients to have long-term, diversified, institutional investment exposures to these persistent mega-themes which are shaping our world of tomorrow.

So, a small confession to make: we decided to take the plunge and try our hand at utilizing AI to help create this quarter’s edition with some help from ChatGPT. It took several refining prompts, uploads of prior versions of Capital Insights to have the LLM mimic our writing style, and several manual edits, but overall, the experiment turned out quite well. While it was a fun exercise to see what the current version of AI can do, readers can rest assured that this was an illustrative exercise and we will be reverting back to our old-school ways next quarter.

That said, what once took an entire weekend to assemble and write, took significantly less time, freeing up opportunity to complete household chores, errands and various honey-do lists, keeping domestic relations chipper and positive. A small illustration of productivity enhancement, perhaps, but simply amazing what technology is enabling all of us to do. We are proud that we can provide our clients direct and prudent investment exposures to these exciting advancements and opportunities. Thank you, thank you, Mr. Roboto.

We appreciate your continued support of our firm and your trust in our team. If you know of someone who might benefit from our services, we would welcome your referral. Until next quarter, we wish you a wonderful Fall season with friends and family.