Committed to Preserve & Grow Your Wealth

We manage your wealth like it is our own.

At Capital Planning, we invest meaningful personal capital in investments recommended to clients, creating long term and conflict free alignment with client interests and goals. We build and manage diversified portfolios that incorporate both public and private equity, credit, real estate and infrastructure investments.

As a Capital Planning client, you’ll benefit from your own dedicated team of senior principals focused on your values, investment objectives, wealth and business structure, and unique personal circumstances. Every client story is unique and matters to our team.

As wealth managers, we diligently work to ensure each area of your finances is actively at work to maximize your financial success. Each client receives the excellent multidisciplinary personal service our boutique firm is known for.

Dynamic Investment Management

actively monitoring & adjusting as the market changes

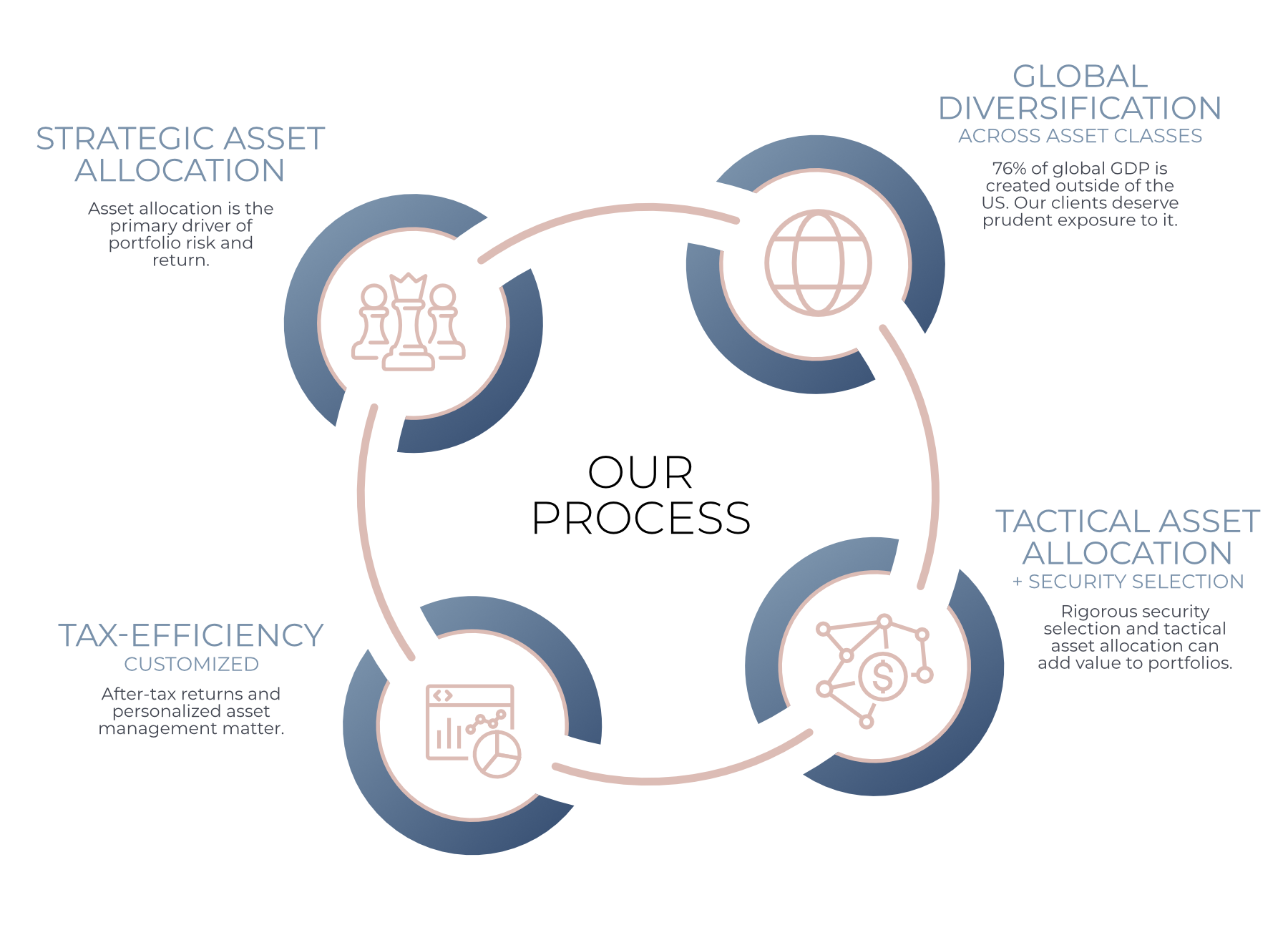

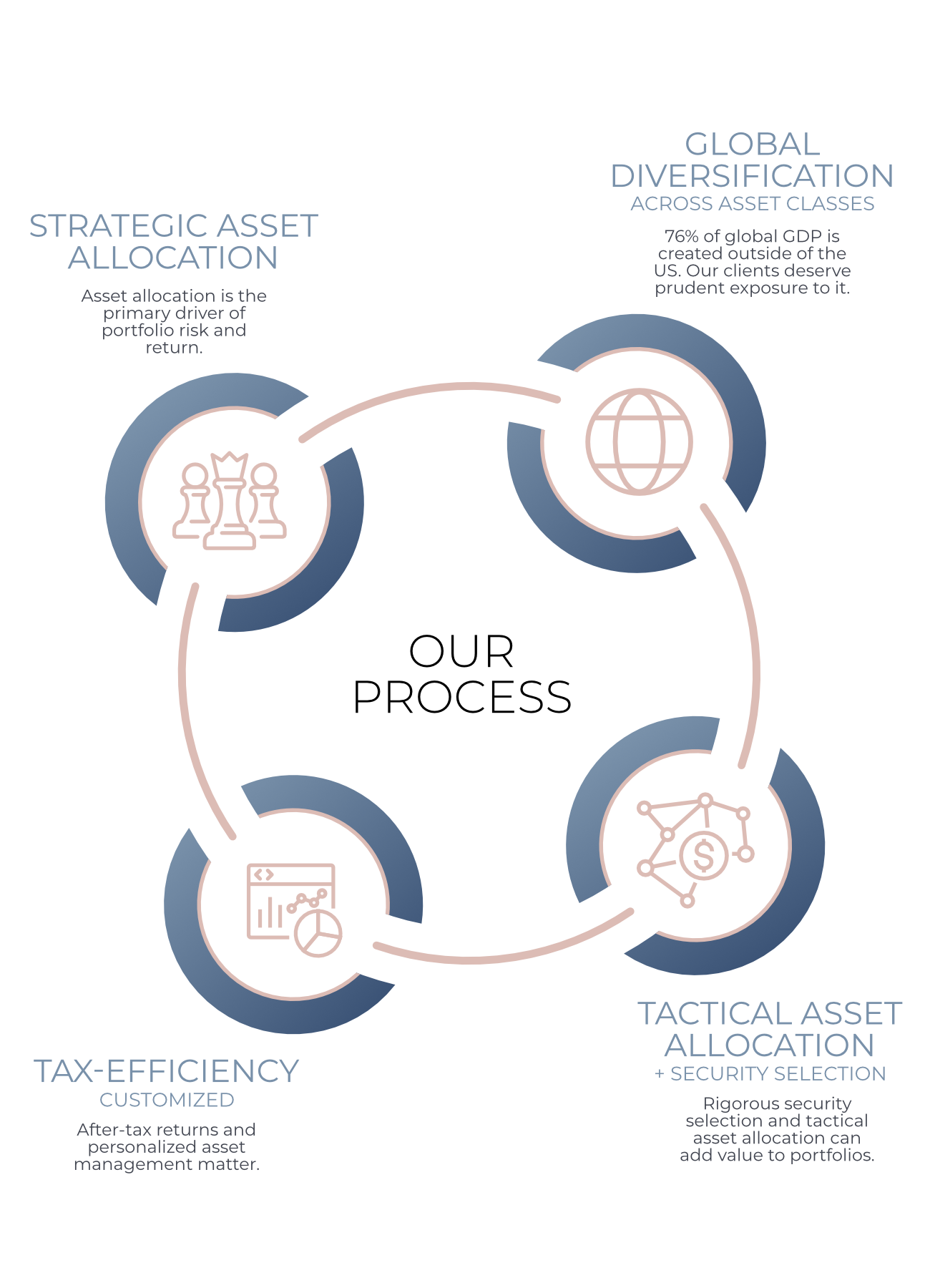

At Capital Planning Advisors, we leverage independent, institutional-quality investment research and tools to build custom-tailored portfolios centered on your specific goals and objectives.

Our experienced team of investment professionals constructs globally diversified, risk-balanced portfolios and manages your assets with a personalized tax and cash flow in mind. In addition to using public securities, we provide our clients access to unique and compelling private capital strategies from a curated list of globally recognized institutional sponsors.

Investment management is an ongoing, dynamic process in a constantly evolving environment. In addition to thoroughly vetting and screening all investment ideas and vehicles, our team actively monitors and adjusts portfolio risk exposures as the market environment changes.

Professional advice makes a difference when it comes to preserving and responsibly growing your wealth.