Nobody ever said reopening the planet was going to be easy. With roughly a quarter of the world’s population now vaccinated against Covid-19, surging economic activity combined with wobbly supply chains have created massive imbalances throughout the global economy. The daunting logistical challenges of the world’s reboot are perhaps best epitomized by mishaps such as the Ever Given’s blockage of the Suez Canal, which in six days stymied 369 container ships from transiting and cost an estimated $10B worth of trade. These global events are impacting local, everyday life: from housing and autos, to milk and eggs, prices are up and inventories are down as producers struggle to produce and distributors struggle to distribute in a world that is still grappling with emerging variants and too many “Now Hiring” signs.

Fears of rampant and persistent inflation and an overly-hawkish Fed are overblown. Yes, inflation has clearly returned, but there is strong evidence that indicates this spike is temporary and already fading.

Figure 1: TIMBER!…Lumber Prices Down Materially.

Source: Cornerstone Macro

Only an off-the-grid survivalist would be unaware of the meteoric rise in home prices, rents and new residential construction in the last 18 months. Since housing and shelter comprise roughly 40% of the consumer price index (CPI), one does not have to be a mathematician to understand how this surge of home demand has impacted headline inflation numbers. Like any market, too much demand coupled with too little supply boosts prices until the point of demand destruction. Supply growth eventually catches up and prices decline back to a more sustainable market-clearing level. This exact situation has played out in the lumber markets, which are both a major input as well as a leading indicator of home prices.

Another reason for this current spike in inflation is pent up consumer demand. Consumers, flush with cash from fiscal stimulus programs, have pushed nominal spending past pre-pandemic highs. Figure 3 illustrates the strong correlation between disposable personal income (DPI) and CPI, and as these transfer payment programs wind down, we expect a corresponding abatement of inflationary pressure.

Figure 2: Shop ‘til You Drop…Nominal Spending Back to Highs…

Source: Cornerstone Macro

Figure 3: …However, Fading DPI Growth will Slow CPI Growth.

Source: Cornerstone Macro

While we expect to continue to see rising prices in sectors that benefit from the reopening, pricing power is starting to fade in sectors which comprise a larger percentage of the overall the CPI calculation, such as autos, furniture, and recreation. This rotation will also help to bring headline inflation numbers down in the coming months.

Figure 4: Rotation in Pricing Power Indicates More Moderate Inflation Ahead.

Source: Cornerstone Macro

Last quarter we wrote we were keeping our eye on wage inflation and the importance of it maintaining a reasonable growth rate. As unemployment falls, the Employment Cost Index (ECI) rises, which puts upward pressure on wages. However, total nonfarm productivity has continued to ramp up at a nearly equivalent pace, offsetting the potential negative effects of this recent above-average wage inflation. The net results look like unit labor cost growth should remain near 1%, which in turn should keep core inflation manageable. Due to continued advancements in technology and innovation, we believe this trend is sustainable throughout this reopening process.

What about the Fed? While there is no shortage of expert opinions on the merits or faults of current Fed policy, the 25% decline in 10-year yields over the last three months seems to indicate that the bond markets are not too concerned with runaway inflation either. Money supply (M2) growth has declined significantly, further bolstering our view that we simply are in an extremely unusual but short-lived inflationary environment. Other central banks such as the ECB and PBOC seem sanguine about the issue as well as they are also maintaining very accommodative policy stances.

Figure 5: M2 Decline Is a Welcome Sight.

Source: Cornerstone Macro

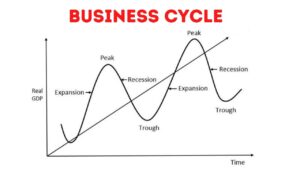

Navigating this environment has been admittedly tricky, and from a portfolio perspective our investment team has been very focused on separating signals from noise and ensuring we are being proactive versus reactive. As Covid-19 has accelerated many things in life, it also accelerated this miniature bust-boom economic and market cycle, with leaders swinging to laggards one month, only to flip-flop positions during the next.

Over the past quarter, we further adjusted our equity exposures to capture a bit more cyclicality while still maintaining our secular bias towards growth and Innovation themes. Economies that reopen first ought to maintain a competitive advantage over those that are further behind the curve, so we are still tactically overweight the US relative to international equities. We also continued to increase allocations to various Private Capital investments as we believe this environment is rife with opportunity for skilled sponsor firms.

Figure 6: Vaccine Tracker: Green is Good.

Source: Bloomberg

We expect a two-steps-forward, one-step-back market environment as this uneven global reopening process continues. On the one hand, a larger vaccinated portion of the population allows for a more rapid return to normalcy (and presumably a more regular market and economic environment), on the other we continue to face the rising threats from new variants as well as increasingly sharp geopolitical rhetoric between China and the Biden Administration. We expect these competing forces to introduce some mild volatility into the public markets in the back half of this year, but overall, the macro environment continues to improve and favor risk assets.

Our Capital Insights readership continues to grow substantially and now encompasses clients, prospective clients, strategic partners, as well as friends of our firm. To our clients, we deeply appreciate your business and trust in your Capital Planning Advisors team. If you are not a client and are contemplating initiating a relationship with us, either directly with your personal or business assets, or by referring someone you think could benefit from our services and approach, we would be delighted to speak with you.

We continue to experience steady and stable growth and we are grateful that everyone on our team is healthy and safe. We sincerely hope that you and your loved ones are keeping well and please do not hesitate to contact us if you have any questions or if we can be of further assistance.